Another solid quarter

Envirosuite provided a Q3 sales update and in short the company delivered another solid quarter. The key new ARR figure for the quarter was A$2.0m which was around what we expected – we don’t forecast quarterly new ARR – and was up slightly on the A$1.7m in Q1 and A$1.8m in Q2. Importantly, however, the new ARR was driven by good growth in each of the divisions unlike previous quarters where the growth was more driven by a single large new contract. The reported ARR at the end of Q3 was A$49.0m which was flat on Q2 but this was due to the negative impact of currency movements (the constant currency ARR increased from A$48.6m at the end of Q2 to A$50.0m at the end of Q3). The one other key take-out from the update was WA’s Water Corporation added a fourth site with Envirosuite’s SeweX product and this suggests the customer is happy with the product and a wider rollout is likely.

Modest downgrades

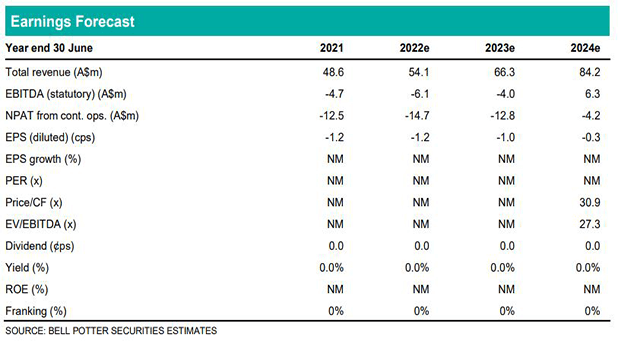

We have modestly downgraded our revenue forecasts by 2%, 3% and 3% in FY22, FY23 and FY24. We have also modestly increased our forecast EBITDA losses in FY22 and FY23 and reduced our forecast positive EBITDA in FY24 on the back of the lower revenue. The downgrades are driven by currency and also a reduction in our ARR forecasts at year end which lowers the recurring revenue forecasts. Note we now forecast ARR at year end of A$51.2m in FY22 – versus A$54.6m previously – and a key driver of the downgrade is we no longer assume a material contract from WA’s Water Corporation this financial year but rather next.

Investment view: $0.25 PT unchanged, Maintain BUY

We have updated each valuation used in the determination of our price target for the earnings changes as well as market movements and time creep. We have also increased the premium we apply in the EV/Revenue valuation from 10% to 15% given the potential catalysts we see of strong new ARR in Q4 – we forecast around A$3m before churn – and an update on the Water division next month. The net result, however, is no change in our PT of $0.25 and we maintain our BUY recommendation.