Refinancing deal 8.5% accretive to FY22e

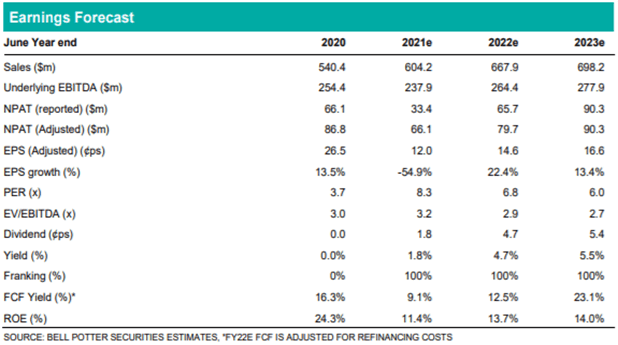

EHL has announced that it will issue A$250m of Senior Secured notes to refinance its existing US denominated debt. The notes will have a have a fixed coupon rate of 6.25% versus the current effective hedged rate of 9.86%, resulting in ~$9.0m per annum of interest savings (8.5% accretive to FY22e Underlying EPS) and extending the debt maturity to Jul’26 (previously Mar’24).

We expect the actual payback to be ~2 years after accounting for the issuance fees (BPe $5m), repayment premium of 4.625% (~$11m) and costs related to closing hedging positions early (BPe ~$4m).

Surge in coal prices presents upside

EHL has reiterated its guidance for FY21e Operating EBITDA to be between $235- 238m (BPe $237.9m), although we believe coal prices should see EHL go top of range. Prices of metallurgical and thermal coal have increased by +62.3% and +37.1% respectively since the guidance was first provided on the 23rd April, incentivising increased operating utilisation of the eastern fleet (60% of 1H21 Operating EBITDA).

Sustained elevation of coal prices would likely speed up redeployments of latent equipment on the east coast (BPe ~$15-20m of annualised Operating EDITDA) and increase operating utilisation, presenting upside to FY22e consensus estimates.