Navigating strongly versus disruptive backdrop

We largely anticipated a vanilla AGM for DGL as the company begins working through the initial stages of integrating a combined seven new businesses ($69.5m), or 25 new sites, into its Trans-Tasman chemicals logistics network. As such, the highlight of the AGM was DGL effectively disclosing guidance on these acquisitions in the order of $15.0m pro-forma EBITDA in FY22e. This amount implies minimal earnings slippage, if anything, on LTM earnings from these businesses prior to acquisition ($15.2m), and against a challenging backdrop of disruption in supply lines and significant raw material price inflation, we view this as a positive outcome. Other relevant commentary included DGL continuing to perform “in-line with expectations”.

Tapering DGL’s pricing and leverage to LME lead in 2H22e

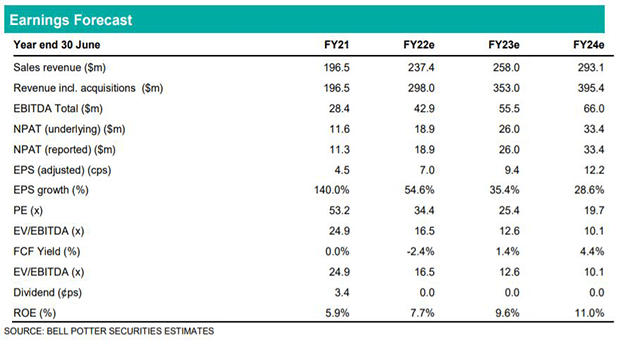

In Australian dollar terms LME lead has averaged A$3,170/t during 1H22e, up >18% on the average of 2H21. Market tightness has persisted due to (1) China announcing that metals processing and lead battery manufacturing will be be targeted with stricter pollution limits; (2) force majeure at major primary lead smelters in Europe (Stolberg) and in Henan, China; and (3) discrepancies in stock registered with LME (record lows) and Shanghai Futures (record highs) – exacerbated by supply chain issues. We think China possibly relaxing bans on Australian coal, along with recent signals that lead stocks are beginning to leave China poses downside risk to prices in 2H22e, particularly if improvements to bulk shipping result in possibly sudden LME deliveries. We elect to bring forward our long term pricing assumptions to 2H22e ($A2,800/t, prev. A$3,000/t) and take a more conservative view on DGL’s earnings leverage to lead (+/- 5% price now ~$0.8m EBITDA, prev. ~$1.0m) over FY22e – in part given that there is no guidance to DGL’s core business (Feb ’22). Underlying FY22e EBITDA is reduced to $33.4m (prev. $34.4m) however there are no other material changes to forecasts.

We believe DGL is in position to annualise $42.9m EBITDA equating to 51.1% YoY growth in FY22e ($48.4m pro forma). In our view, guidance on acquisitions is a small step towards DGL validating its growth strategy, focused on industry consolidation, as one that is scalable and sustainable. We reiterate our Buy rating and $3.00ps PT.