Channel checks point to improving industry optimism

We recently hosted a series of meetings with convenience retail (fuel station) industry experts spanning private buyers, valuers, agents and operators. Coupled with feedback from retail shopping centre industry participants, and improving cap trans market volumes we expect to see strong investor interest across the broader retail sub-sector universe driven by: (1) Increased capital market interest (vs. other subsectors, plus within categories eg petrol stations vs. pad sites); (2) Opportunity for tenants to realise improving margins from convenience retail (eg food on the go, higher margin categories); and (3) Build-up of undersupply but yet new operators looking to enter the market (both domestic and international).

Industry data & newsflow highlight fuel reliance for longer

In the last few weeks multiple car manufacturers (eg VW, Mercedes) have dropped plans for all-electric fleet targets, with new car sales data continuing to point to robust, and steadily growing fuel reliant sales (+9% CY24 vs. CY22) with more vehicles entering Australian roads.

Indeed, VFACTS and CarExpert data to February highlights: (1) Aus vehicle sales +10.4% m/m, -7.9% y/y with total monthly new vehicle sales (96.7k at Feb) remaining in a 90-110k band each month last 2yrs; (2) Fuel reliant car sales +10.0% m/m, -7.8% y/y; (3) EV sales +48.3% m/m, -43.8% y/y with no single month above 10k sales LTM.

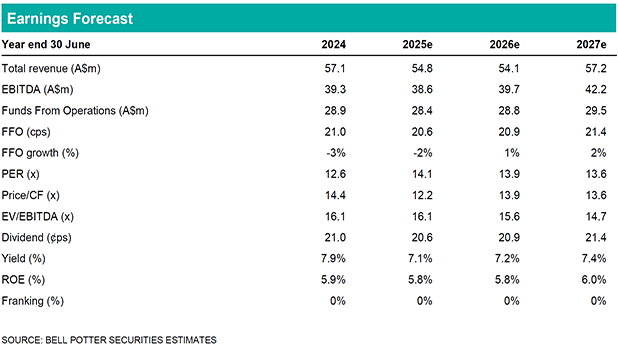

Investment view & Earnings changes; Buy

No change to our Buy recommendation, as we make minor -1% to +1% changes to our FY25-27 FFO / share estimates accounting for CoD and asset sale timing. We see an improved valuation outlook (-10bp cap rate compression in our NAV), and also see the prospect for further industry consolidation and inbound (new to market) operator interest as the success of operators like OTR with high margin retail can translate to underinvested highway sites, and large-scale regional sites / areas. This should provide valuation upside (DXC trades at -19% discount to NTA) as we cycle trough levels, and receive a high 7.2% distribution yield on the way through.