1Q22: ~$2.20bn unaudited cash NPAT (BP $2.36bn)

CBA’s 1Q22 result components are: 1) unaudited statutory NPAT ~$2.30bn (BP $2.51bn); 2) unaudited cash NPAT ~$2.20bn (BP $2.36bn); 3) operating income down 1% but flat excluding AHL with above system growth offsetting margin pressure and lower non-interest income; 4) operating expenses down 1% – lower remediation costs more than offset higher staff expenses; 5) credit quality stable and reverting back to normal – loan impairment expense $0.10bn or 5bp GLA (BP $0.24bn); 6) credit provisions unchanged; 7) strong balance sheet – 74% customer deposit funding ratio, 131% NSFR and 132% LCR; and 8) Level 2 CET1 capital 12.5% (BP 12.0%) – net of final dividend and buyback, the ratio would be 11.2% (but climbing back to 11.6-11.7%

with announced asset sales).

Operating income was disappointingly and 1% lower with 1% higher net interest income more than offset by much lower non-interest income. On the other hand, growth was ahead of system in core markets at $17.0bn but this was offset by lower NIM. Non-interest income was also 8% lower due to the removal of AHL among other things (excluding these, it was better and flat overall). Finally, operating expense was down by 1% and driven by lower remediation costs (but was only 3% higher mainly due to staff expenses plus 1.5 additional working days). Overall, cash NPAT of around $2.2bn was still higher than for the same period last year – a plus in a way.

Price target a more realistic $111.00 but maintain Buy rating

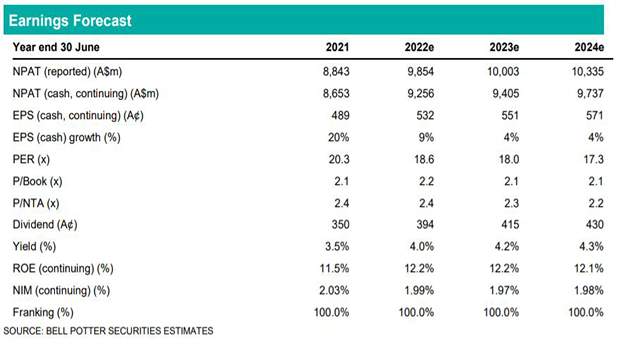

Given its lower quarterly performance, CBA’s cash NPAT is reduced by 3% across the forecast horizon. This is mainly due to lower NII (-1%) and other income (-2%) but flat in total excluding the AHL divestment (above system growth that offset margin pressures and lower other income), slightly lower operating expenses (+1% based on lower remediation costs) and just a minor change in loan impairment expense in FY22 of -33% (i.e. a lower expense). The price target is however lowered by 6% to $111.00 (previously $118.00) after also considering added dividend and ROE risks. Based on a 12-month TSR of greater than 15%, CBA is still regarded as a Buy.