Company background

Cobram Estate Olives (Cobram) is a vertically integrated producer and marketer of olive oil products with operations in Australia and USA and export customers in ~17 counties. Established in 1998, today Cobram owns or leases ~6,889Ha (~99% company owned) of maturing olive groves across Australia (6,584Ha) and California (305Ha), with ~3,182Ha of olive suitable land for expansion, and packaged olive oil sales reaching $123.2m in FY21.

Fast growing brand with maturing orchard assets

Market leading Australian brands: Cobram has developed and owns two market leading Australian olive oil brands in Cobram Estates and Red Island which combined account for ~45% of the Australian Extra Virgin Olive Oil (EVOO) market, a segment which has seen retail sales value has grown by +37% since FY17.

Exposure to a maturing orchard asset base in Australia: ~39% of the Australian orchards have yet to reach maturity and ~15% have yet to reach first harvest. Maturing company orchards combined with access to additional fruit from immature third party plantings provide access to a step change in olive oil volumes over the next decade.

Exposure to a North American development asset: Since FY14 Cobram has grown to be the third largest producer and second largest Californian olive oil brand in the US. The transition from bulk to branded producer should benefit margins in the long run, while providing an outlet for any surplus oil inventory from the Australian groves.

Investment view: Initiate coverage with an Buy rating

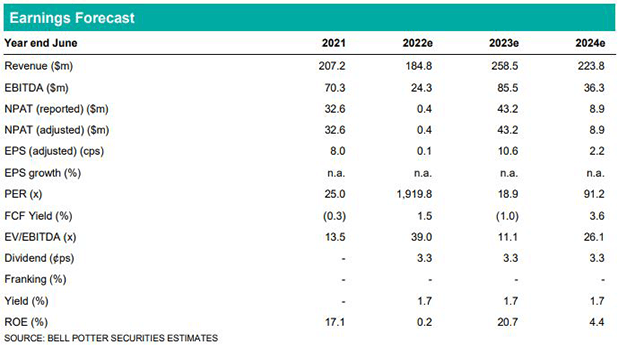

We initiate coverage on Cobram with a Buy rating and $2.30ps target price. Cobram offers exposure to a premium FMCG brand in a fast growing market. In addition the business should benefit from an expanding orchard asset base lifting oil supply and through the cycle earnings. As a compliance listing that provides a liquidity event, there is the potential of a near term stock overhang. However, we would see liquidity in an off production year as likely to provide buying opportunities.