Strong 3Q trading ahead of BPe

Cettire (CTT) provided a trading update for the first 4 months of 2H23 (Jan-Apr) and sales revenue of $141.3m (+122% on pcp) and Adjusted EBITDA of $7m were beats to BPe. The 4Q has commenced well with April sales revenue +160% and guidance for similar growth rate in May/June. Key metrics including orders, customer adds, average order value, repeat rates and App performance are tracking well. The cash position of $39m reflected the settlement of trade payables from the seasonally larger December quarter, therefore we expect the 4Q seasonality (second largest contribution to annual revenue) to assist the improvement in the cash balance to end the year in a healthy cash position (BPe cash balance ~$51m as of end of FY23e).

Earnings changes

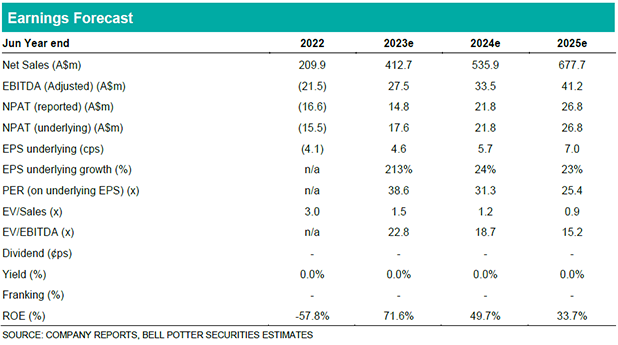

We upgrade our revenue forecasts to incorporate 3Q/4Q23 revenue beats (3Q23 ~25% higher than previous BPe, while 4Q at company guided growth ~30% ahead of previous BPe). This drives upgrades to our FY23 Adjusted EBITDA estimates, while we expect some incremental margin benefits in FY24/25 on marketing investment and fixed operating costs. We now forecast ~160% net revenue growth in the seasonally strong 4Q23 assisted by supportive comps (lower marketing spend/revenue growth in the pcp) which would see 4Q dominating as the highest contributor to the FY23 annual revenue. Our Adjusted EBITDA margins remain at ~5% for 4Q23, as we estimate delivered margins of ~23% and marketing investment at ~10% of net revenue. The net result sees our NPAT forecasts +2%/+15%/+5% for FY23/24/25e.

Investment View: PT up 4% A$2.50, Maintain BUY

Our Price Target increases 4% to A$2.50/share (prev. A$2.40/share) driven by our earnings upgrades and changes to cash flow assumptions to reflect movements in working capital. We think CTT will continue to outperform its peer group consisting of global luxury retailers and local e-commerce players given its <1% market share in a large and growing market which could remain more resilient than other discretionary categories in a likely recessionary environment. We retain our BUY recommendation.