Strong revenue growth, FY22 guidance in line vs consensus

BRG announced underlying 1H22 EBIT of $112.5m, up 18.9% YoY and 5.0% ahead of BPe $107.2m. 1H22 NPAT was $77.7m, up 21.1% YoY. Key result takeaways include:

- Strong revenue growth continued, ahead BPe: BRG’s 1H22 group revenue of $878.7m was 9.7% ahead BPe $801.1m. The Global Product segment achieved +23.8% constant currency revenue growth, with all regions contributing strongly.

This includes the Americas +17.1%, EMEA +39.4% and APAC +22.0%. - Margins well managed vs disruptive backdrop/cost pressures: Gross margin was only marginally softer (down -0.9%) with price rises, restrained promotional spend, & mix largely offsetting ongoing inflationary pressures in freight & product costs. 1H22 EBIT margin of 12.8% was broadly in line with pcp of 12.9%.

- Improved inventory position, although more work to go: Inventory % R12M sales improved to 22% (pcp: 14%), although 51% of inventory remains as goodsin-transit (mostly on ships at LA port) as opposed to being in warehouse. Supply chain permitting, BRG plans to build inventory in 2H22 (and overshoot equilibrium levels) ahead of peak season to get in front of any future supply chain problems. BRG’s end-FY22 inventory target is ~$350m (we assume $340m) vs end-1H22 of $293. At end-FY22 we are forecasting net cash of ~$50m (vs 1H22 $31.7m), with the increase in inventory and payables, offset by the normalisation of receivables.

- Outlook comments: Consistent with prior years, BRG intends to invest in R&D, marketing and technology in 2H22 to support growth in FY23 and beyond. BRG also expects to enter new geographies and launch new products in 2H22. FY22 guidance: FY22 EBIT expected to be consistent with consensus of ~$156m.

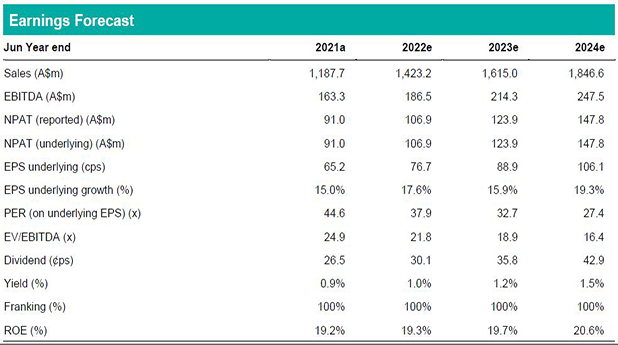

Earnings changes/Investment view: Retain Hold, PT $30.50

We have strengthened our sales forecasts, although offset by slightly lower margins. Net effect is no material changes to our EPS estimates, although time-creep increases our PT to $30.50 (previously $30.15). BRG remains well positioned to drive sustained strong sales growth (pent-up NPD pipeline, new geographies and M&A), although further ramp-up of investment (R&D / marketing) will mean limited realisation of scale benefits over the short-to-medium term. Based on valuation, we retain our Hold rating.