Beware of Monitoring Hours

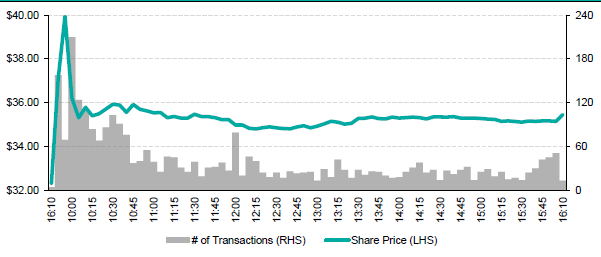

Retail investors belonging to social media trading groups redirected their attention to commodities on 1 February, predicated on a belief that Wall Street hedge funds were short silver. The latest daily short-squeeze attempt sent the spot price of the metal up 6.7%, with ~3,000 transaction being executed in ETFS Physical Silver (ASX:ETPMAG), which incurred a daily volume and value of 1.3m and $47.7m, respectively. ETF issuers will routinely publish an intra-day indicative net asset value (iNAV), which provides real-time guidance on the value of a fund.

This seeks to reduce the possibility of a fund trading at a premium or discount to NAV. As a general rule of thumb, the trading experience is best enhanced when the market is completely open, with Market Makers being more able to efficiently quote buy and sell prices based on the current fund composition. Investors therefore need to be aware of when the underlying markets open and close to ensure best pricing.

For this reason it is advisable to hold off buying or selling an ETF 15 minutes after a market opens and 15 minutes prior to market close. Market Maker orders are continuously updated throughout the day, reflecting price changes in the underlying basket of securities while providing liquidity and a specified buy-sell spread around the true value of the ETF.

Figure 1 – ETFS Physical Silver (ASX:ETPMAG)

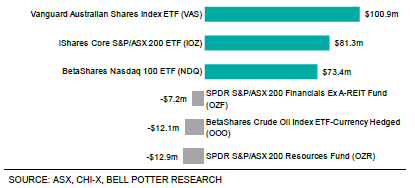

Figure 2 – Top ETF flows for January 2021

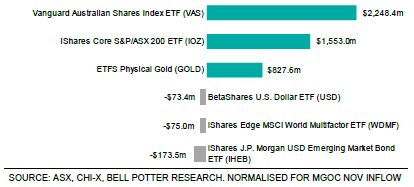

Figure 3 – Top ETF flows for 12 months ending January 2021

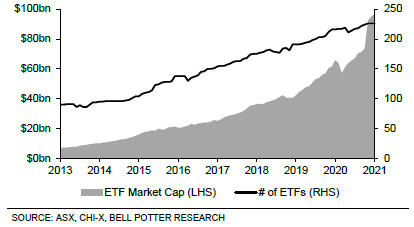

Figure 4 – Australian ETF market size

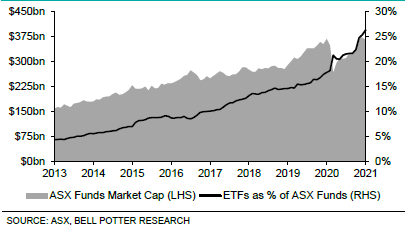

Figure 5 – ASX ETFs in comparison to total ASX Funds

Authored by Hayden Nicholson, ETF / LIC Specialist at Bell Potter Securities, 24 February 2021