Mardie milestones achieved in readiness for development

BCI is now readying for full scale development of the Mardie Salt and SOP project to commence on receipt of final approvals in the current quarter. During the December 2021 quarter: State and federal environmental approval was received; critical land access agreements finalised; BCI’s Board took a Final Investment Decision; and required debt and equity finance for the +$1b project obtained. BCI closed the quarter with $334m in cash and over $900m in undrawn finance facilities.

Iron ore price volatility hits Iron Valley EBITDA

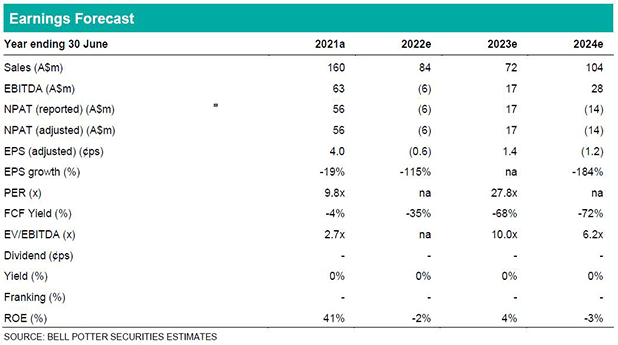

Iron Valley reported significantly weaker quarterly EBITDA of $1.8m and the September quarter result was restated from $17m to $3.5m. The hit to earnings caused by weaker iron ore prices, increased price volatility and increased quality discounts. Iron Valley’s relatively small scale and few monthly shipments exacerbates the earnings impact when cargos are priced at their destination in weaker markets. With iron ore prices strengthening into 2022, BCI expect some of this earnings weakness to unwind. However, persistently high quality discounts have continued into this year. Ordinarily, this earnings weakness would be of concern. However, BCI’s Mardie funding is now arranged with little call on Iron Valley’s earnings to support the project’s development. EPS changes in this report relate to adjustments to our Iron Valley assumptions alone: FY22 now -0.6cps (previously 2.7cps); FY23 now 1.4cps (previously 1.9cps); and FY24 now -1.2cps (previously -1.0cps).

Investment thesis: Buy, TP$0.63/sh (previously $0.66/sh)

The Mardie Salt and SOP project is tier-one in scale and transformational for BCI. The project is nearing final approvals and the commencement of full-scale development. Mardie has received support from government backed debt agencies and commercial lenders, recognising the project’s 60+ year life, strong earnings potential and sustainable, carbon neutral credentials. BCI also has near-term cash flows from its Iron Valley operations.