Relative safety in some banks

The majority of the banks did have a relatively good reporting season in the period ended 31 December 2019. However, all this is now history and what lies ahead in the next 12-24 months will be of more concern as there appears to be no escaping COVID-19 for now. Our 5 March Bank Note$ has already dealt with the impact of slower credit growth and softer NIM on cash earnings but only from the RBA’s recent rate cut perspective. These outcomes in addition to credit quality will likely deteriorate given more recent rate cuts globally and rapidly-softening business conditions and we have further revised our estimates below. In the meantime, we still think the banks have come a long way (since 1987, the early 1990s recession and the GFC) and are much more resilient in dealing with COVID-19. Balance sheets have largely improved over the last 23 years, underpinned by manageable credit growth, better loan book composition, more sustainable leverage, greater retail deposit funding, better overall funding quality including liquidity and materially higher capital levels.

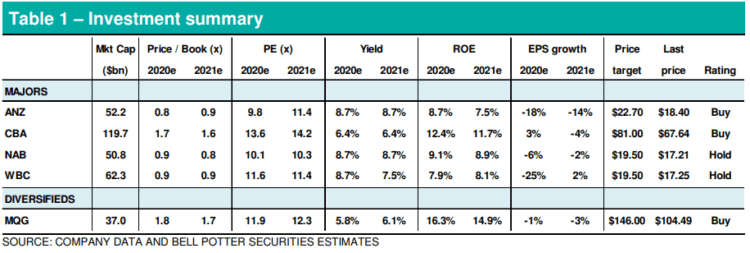

Ratings unchanged – MQG still our most preferred bank

In addition to revising our estimates, we have also rebased valuations given upward trends in the banks’ cost of equity. The required country premium according to Bloomberg has increased by 1.7% since 16 January 2020 – likewise the respective cost of equity figures – and we believe it is only prudent to increase these assumptions for our banks (e.g. the majors’ cost of equity has increased by 1.3-2.7% and MQG’s by 1.4% over the same period). Taking into account medium term earnings estimate changes (ANZ -12%, CBA -6%, NAB -20%, WBC -18% and MQG -8%) and heightened market volatility, our price targets are adjusted as follows: ANZ -13% to $22.70 (Buy); CBA -5% to $81.00 (Buy); NAB -22% to $19.50, (Hold); WBC -19% to $19.50 (Hold); and MQG -8% to $146.00 (Buy). In addition to rankings from an overall risk perspective, our pecking order among these banks are unchanged: (1) MQG; (2) CBA; (3) ANZ; (4) NAB; and (5) WBC. We view MQG as a LONG TERM “Cash and Growth” story – so look past all the current market noise. Its investment proposition is also underpinned by a strong balance sheet, risk management capabilities, ability to deploy resources across the Group to generate returns in excess of those of its peers, ongoing cost discipline, adaptability to changing market conditions and access to value-adding global growth options.

LEARN MORE

If you’re interested in learning about these investment opportunities in the context of your portfolio, get in touch with your Bell Potter adviser. Alternatively, call 1300 023 557 to organise an obligation free discussion with one of our experienced advisers.