Updated capital management guidance

APRA has today updated its capital management guidance for ADIs and insurers and in particular has eased restrictions around paying dividends. That is, the ADIs and insurers do not need to continue to defer capital distributions now provided these are moderate and sustainable and that supporting households and businesses remains the top priority. The regulator’s view is that uncertainty in the economic outlook has reduced somewhat since April and this is after it had also reviewed their financial projections and stress testing results. While ADIs and insurers should remain cautious when planning capital distributions including dividend payments, APRA has indicated for the rest of calendar year 2020 that they should: (1) seek to retain at least half of their earnings when making such decisions (in addition to using DRP and other initiatives to offset consequent capital diminution – this guidance is unchanged) that essentially implies a payout ratio of below 50% in this calendar year; (2) conduct regular stress testing to inform decision-making and demonstrate ongoing lending capacity – no surprises here; and (3) make use of capital buffers to absorb stress impacts (bearing in mind the ADIs need to also manage loans on repayment deferrals) and maintain lending to households and businesses – again no surprises here.

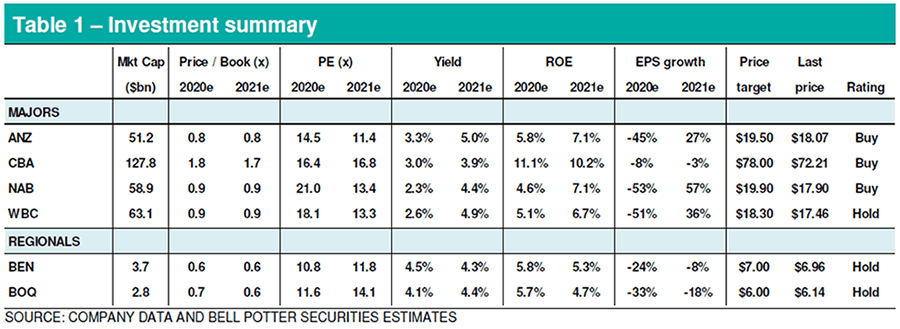

Today’s announcement is great news for all the loyal bank shareholders. The system remains in a strong position and it is good to know of APRA’s desire for ADIs and insurers to continue supporting households and businesses in a prudent fashion. As for the latter, we think the regulator also means supporting households by ensuring sensible dividend flows are made available to them in times of economic uncertainty and low interest rates. In a separate letter to ADIs, APRA does not expect them to meet the unquestionably strong capital benchmarks in the period ahead and any capital rebuild should be orderly – which is exactly what is needed to iron out volatility in this space. APRA’s guidance is similar for insurers, where caution should apply to capital distributions and that payout ratios (in addition to using DRP and other initiatives to offset consequent capital diminution) should be moderated in 2020. Our revised 2H20 dividend expectations are thus: (1) ANZ 60¢ (previously 50¢); (2) CBA 20¢ (previously 100¢); (3) NAB 12¢ (previously 30¢); (4) WBC 45¢ (previously 80¢); (5) BEN nil (previously 14¢); and (6) BOQ 25¢ (previously 10¢).

APRA expects that every bank will do its duty

Updated capital management guidance

APRA notified ADIs and insurers back in April of the expectation “to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance”. The directive mentioned either deferring dividend decisions until the outlook becomes clearer, or to materially reduce dividends after carrying out robust stress tests (in terms of the latter, any such dividend payment should be offset through DRP and other capital management initiatives).

APRA has today updated its capital management guidance for ADIs and insurers and in particular has eased restrictions around paying dividends. This is after getting a stronger sense of COVID-19 impacts on the economy and financial institutions. In other words, the ADIs and insurers do not need to continue to defer capital distributions now provided these are moderate and sustainable and that supporting households and businesses remains the top priority.

The regulator’s view is that uncertainty in the economic outlook has reduced somewhat since April and it has also had the opportunity to review their financial projections and stress testing results. While ADIs and insurers should remain cautious when planning capital distributions including dividend payments, APRA has indicated for the rest of calendar year 2020 that they should:

- Seek to retain at least half of their earnings when making such decisions (in addition to using DRP and other initiatives to offset consequent capital diminution – this guidance is unchanged) that essentially implies a payout ratio of below 50% in this calendar year;

- Conduct regular stress testing to inform decision-making and demonstrate ongoing lending capacity – no surprises here; and

- Make use of capital buffers to absorb stress impacts (bearing in mind the ADIs need to also manage loans on repayment deferrals) and maintain lending to households and businesses – again no surprises here.

Today’s announcement is great news for all the loyal bank shareholders. The system remains in a strong position and it is good to know of APRA’s desire for ADIs and insurers to continue supporting households and businesses in a prudent fashion. As for the latter, we think the regulator also means supporting households by ensuring sensible dividend flows are made available to them in times of economic uncertainty and low interest rates.

In a separate letter to ADIs and as announced in March 2020, APRA does not expect them to meet the unquestionably strong capital benchmarks in the period ahead (although the ADIs are free to use management buffers to absorb stress impacts and maintain lending support to the system) and any capital rebuild should be orderly – which is exactly what is needed to iron out volatility in this space.

APRA’s guidance is similar for insurers, where caution should apply to capital distributions and that payout ratios (in addition to using DRP and other initiatives to offset consequent capital diminution) should be moderated in 2020.