Products, growth and positioning

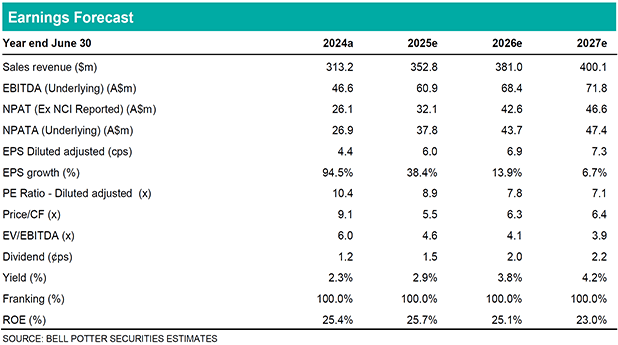

Austin is a World class manufacturer of truck bodies/trays for mining dumper trucks and buckets for shovels and excavators. The company is performing well as a result of the Austin 2.0 program started in 2021 under CEO David Singleton. This strategy has seen new product introductions, an improvement in sales from new contracts and a reduction in cost as a result of centralised purchasing and lower cost manufacturing. This strategy saw group revenue advance by 21% to $313m in FY24, with EBITDA increasing by 49% to $47m, and margins rising to 15% from 12%. The company is upbeat guiding to a 12% increase in revenue in FY25, and a 35% increase in EBIT.

ANG maintains a strong position vs OEM manufactured truck bodies (Caterpillar, Komatsu, Hitachi, Liebherr, etc) due to features such as lower weight, ability to customise to mine requirements and fabrication proximity to client. OEMs seem comfortable with ANG and others selling bodies and we presume the OEMs make higher margins on other spare parts. ANG maintains strong IP and high customer retention (of 89%). There are several companies competing in Australia (including Schlam, Jaws, Duratray, and ESCO part of Weir Group plc). This structure is both an opportunity and a threat, providing competition. ANG could potentially acquire a competitor and achieve synergies. Weir group has considerable resources (MCap £5.7bn) and while we do not think likely, acquiring ANG would be an attractive addition to its business, especially given ANG’s market share and low relative valuation.

Investment view: BUY PT $0.86/sh

We initiate coverage with a BUY recommendation, based on 1) Market Position as ANG maintains leading positions in its markets, with strong IP, 2) Its products are attractive to end users, improving their yield and efficiency leading to repeat business, overhaul and repair, 3) Austin 2.0 is continuing to deliver opportunities to grow, reduce cost and improve its margins. 4) The valuation is not demanding, compared to similar companies. 5) Fragmented industry, with smaller competitors, creating opportunities for consolidation. Our target price is set using a DCF with a WACC of 9.8% and adjusting for net cash and leases.