Australia’s largest defence exporter

Austal Ltd (ASB) is an Australian shipbuilder and defence contractor providing design, manufacturing and support capabilities for defence and commercial customers. The company is Australia’s largest defence exporter and in the last 35 years it has contracted more than 350 vessels across 59 countries. The company is headquartered in Henderson, WA and operates 5 shipyards across 4 countries.

Record contract book

ASB is set to enter FY24 with a record contract book of ~$11b AUD, with recent contracts such as the OPC (~$4.3b), the T-AGOS (~$4.7b) and the likely award of the EMS (~$1.25b) contract, providing a deep pipeline of work for the next decade. These programs were vital to replace the two major programs, the LCS and EPF, which were historically the foundation of Austal’s contract book, with both programs scheduled to deliver their final vessels in FY26.

Structural tailwinds driving growth

Austal’s expansion into steel shipbuilding has reaffirmed its place as a key pillar in the US naval industrial base and positioned itself to be a prime beneficiary of structural growth in both the Australian and US markets. Naval shipbuilding is experiencing significant tailwinds including 1) record defence expenditure globally, 2) renewed emphasis on maritime capabilities due to potential conflict in the pacific and 3) increased work domestically in light of the AUKUS agreement and release of the DSR.

Investment view: Price target $3.10, Initiate with BUY

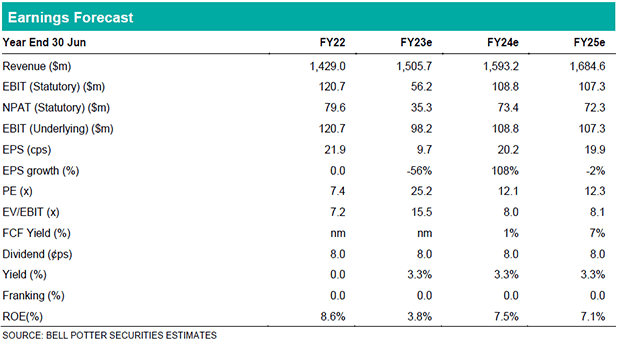

Despite the strong SP performance, we are comfortable ASB still has a level upside before reaching its fair valuation. ASB is currently trading on 7.8x EV/EBIT and 12.1x PE, based on our FY24 forecasts, and is evidently undervalued versus its peers. We believe a PT of $3.10 is a relatively undemanding valuation at this stage considering the record contract book, potential for new contracts and private equity interest.