Bullish signs for 2021 in Australia

Australian and global economies in 2021 will grow about 1.3% faster than forecast in December, according to the OECD. Research from the international policy body anticipates that after contracting by -3.4% in 2020, the world economy will rebound by 5.6% this year. In line with this, it looks wise to stay long resources for the next couple of years, because they’re in a “supercycle”.

Looking across some of the most prominent Australian measures of business and consumer confidence:

- The most recent NAB Business Survey indicates business confidence has risen to a 10-year high and business conditions have now exceeded pre-pandemic levels. Business conditions rebounded by 6 points to 15 in February, while Business Confidence rose to a 10-year high of 16.

- The Westpac-Melbourne Institute Index of Consumer Sentiment increased by 2.6% to 111.8 in March, hitting decade highs and moving well above the historical average of 101.3. The “time to buy a major household item” index rose to 123.7, though, surprisingly, remains below the long-run average of 126.7. House price expectations rocketed to a new seven-year high at 159.5 – but maybe more are thinking it’s getting a bit hot, with the “time to buy a dwelling” sentiment slipping to 116.4. This is further suggested by the study’s measurement of “real estate as the best place for savings,” which fell to its third-lowest reading in history at 9.3%.

Supporting all the other positive jobs data we’ve seen, unemployment expectations continue to fall, down to 112 – also at near-decade-lows, and way below the historical average of 130.1.

“The Reserve Bank of Australia’s Governor Philip Lowe also this week pushed back on the market’s pricing in expectations of a rise in the official cash rate as early as next year. He said while there is scope for a wide range of views on the outlook, the RBA anticipates this won’t need to rise from its current level of 0.1% until at least 2024.”

There is a big “fear” that inflation is coming back and is overdue

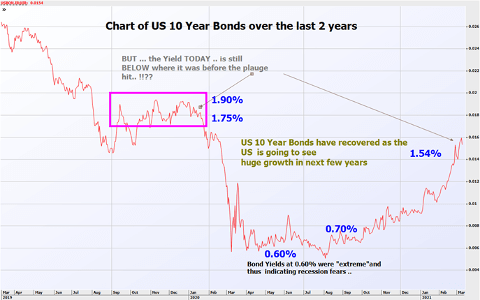

The chart below shows US bond yields, but no one mentions they are still “well below” where they were before COVID decimated world economies.

Instead, they look at where yields were, at around 0.6%, last year and say “hey, look, yields have increased from 0.6% to 1.6% (back to 1.5% on Tuesday night) – so inflation is coming back”.

Also with this “rise in inflation expectations” the bond yield/tech company valuations indicate that tech will be potentially whacked hard. But after hitting record lows, US Yields were always going to increase as the world (including the US) recovered.

If US 10-year yields stay around the 1.8% to 1.5% range for 2021, do you really think that tech and growth stocks more generally are not going to rebound?!

Below is a chart of US Bonds in the last year (see where they are now versus pre-COVID)

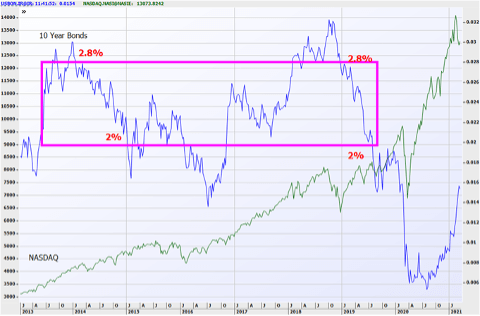

Further below, the chart shows US 10-Year bond yields versus the NASDAQ since 2013.

In that timeframe, we’ve seen the NASDAQ rally every year bar one. And this is despite the yield sitting between 3% and 1.9% between 2013 and 2019.

“So, yields sitting in the 1.5% to 1.6% range is not enough to kill the tech rally just yet! I mean sure, this will calm tech down – and something needs to. But a bubble-bursting type of crash like we saw in 2000, which many have been calling for the last two or three years, still looks very unlikely.”

I still think our current scenario is more like that of 1998 right now – we’re not at 2000 yet.

The following table shows the NASDAQ’s yearly moves (all up except one), alongside the (high) US 10-Year Bond yields at the time

The chart below compares the NASDAQ versus US 10-year bonds since 2013

Despite 10-year bond yields being in the 2% to 2.8% band (see the pink box in the chart) for about six years, we still saw the NASDAQ rally strongly, accompanied by the calls every year of a bubble or crash, which never came).

With yields now up to just 1.5% or 1.6%, it looks as though – from a historical view – the valuation argument is somewhat relevant, but is not as dominant as many are screaming.

Also, you’ll find that many (or most) who are arguing this point are Value managers who have been to hell (and back), so are looking more at where US Yields were seven months ago, rather than where they are now.

“Maybe I’m wrong and this will be a big thing in 2021, but unless we see clear evidence that inflation really is (finally) raising its ugly head, then I believe tech/growth stocks can very easily withstand a US bond yield of less than 1.9%.”

But of course, until we look back after hitting the end of 2021, we really don’t know whether this “force” that is dominating right now continues or pulls back into the background.

Short-term rates are going to remain low for many years

The surge in bond yields has been used by the market as an additional excuse for its “tech witch hunt” – to sell (overcrowded) tech stocks.

There are plenty of experts who will tell you why bond yields are going up. Some point to inflation – ignoring comments by Powell indicating it will take three years for the Fed to achieve its inflation goals – or a sign that the economy is going well, or selling bonds and buying equities.

Right now, it seems many investors, traders, analysts and strategists are getting more comfortable about the coming global recovery. This is one key reason we have seen bonds dropping in price (yields rising) – which is exactly what you would expect.

But it has repercussions elsewhere.

- Obviously, as yields rise, bonds become a more attractive alternative to the riskier growth names (tech stocks). That is what we are seeing now.

- Some were getting almost no growth from government bonds, so have been taking on more risk with stocks (and more-so by piling into growth stocks/tech stocks).

- With bond yields going up, suddenly some investors will reconsider that risk equation, being far less enthusiastic about paying up for those same growth names.

This is why they’ve sold off and that’s what we’ve seen over the last four weeks. But we have seen this many times in the past. While the Fed and RBA maintain with 100% certainty that short-term rates are staying kaput for the next two to three years, this issue will pass sometime in the next month or two.

“For now, the bears and worriers need something to scare us, as they’ve been rapidly running out of reasons why the market will get smashed. The bears have had a “12-month shocker” but to their credit have “maintained the rage”.”

Powell has confirmed he is maintaining the status quo, so there is zero chance of a rate hike in 2021 or 2022.The Fed has made it abundantly clear it will tolerate higher inflation in the short-term – until the economy and unemployment are in better shape – thereby assuring everyone that rates are not going anywhere. .

But the market seems to have put its hands over its ears and is not listening. Instead, it is becoming more fixated on that old Frankenstein – inflation – with expectations rising, and this is causing the latest round of angst.

Powell just confirmed the Fed will remain “accommodative” (low rates for years), so is happy to allow inflation to increase. That will bring in big debates (and fear) that the Fed is “behind the curve”. And when that happens, history tells us what can come next.

We saw it in the “1994 Bond Market massacre” – I’ve mentioned it many times in the past – where the Fed got “behind the curve” and was “forced” to double the Fed Funds rate from 3% to 6% in a single year. But the US economy was running red hot and continued glowing a full six years after, the S&P 500 that year remaining unchanged (as the US economy was doing so well).

So, there will be some who fear this and they will tell us as well.

What does this mean for investors?

If the Fed was “forced” to raise rates sooner rather than later, I’d certainly want to have lowered my stocks exposure beforehand, particularly my holdings of tech and growth names.

All we are seeing now, with techs across the globe being smacked (until this week’s rebound, the NASDAQ had dropped 10% quite quickly) is a mini dress rehearsal for the big event.

We know it will come – but we don’t know when.

When will the party get shut down?

It’s like being at a party, where it’s only 7 pm and already the police have visited. Do you leave now and completely miss the next five hours of partying that will continue until it gets completely closed down at 12? No – because you’ve had too much to drink, and now everyone is on the dance floor – even some of the bears have snuck in for a quick dance (this is the classic signal that the end is near).

The bears know (well, they think they do) that they will simply sneak out before things get out of control. So, you keep partying, losing your sense of time and now have no idea how close you are to the complete lockdown. This comes out of the blue, and as always, no one really sees it coming until it’s too late.

“As far as historical comparisons go, if I had a year to pick I’d say it’s still 1985 (not 1987); or 1998 (not 2000); or 2006 (not 2008). There is at least one year, more likely two, before the alcohol gets turned off, the lights go out and we are being mauled by a very hungry and angry bear.”

So, I suspect much of this will pass by late March or early April!