AKE-LTHM Scheme implemented; enter Arcadium Lithium

On 5 January 2024, the Allkem-Livent (AKE-LTHM) Scheme of Arrangement was implemented. The combined group is now NYSE-listed as Arcadium Lithium (NYSE: ALTM) with ASX-listed Chess Depository interests (ASX: LTM). We are not expecting a material market release from LTM until late February 2024 (10K annual report) and this will depart from AKE’s previous quarterly disclosures.

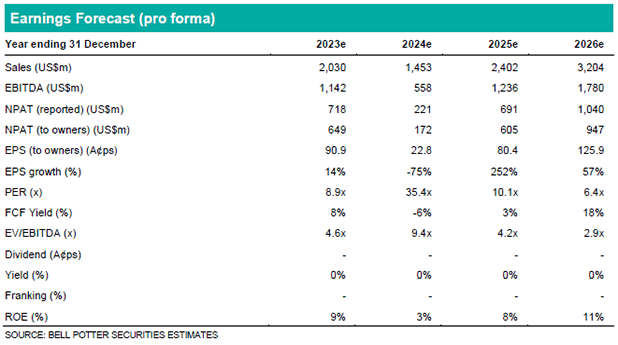

This report provides a primer on LTM’s key assets, our first estimate of the Group’s earnings outlook and our revised lithium price outlook.

Portfolio summary: Tilt to downstream value adding

The transaction brings increased scale and a tilt to further downstream value adding:

Argentina brine assets: Producing assets Olaroz (AKE, 66.5%) and Hombre Muerto (LTHM), and currently under development Sal de Vida (AKE).

Hard rock assets: The producing Mt Cattlin mine (AKE) in Western Australia, and two development projects in Quebec Canada being Nemaska-Whabouchi (LTHM 50%) in development and James Bay in advanced permitting stage.

Downstream: AKE’s Naraha lithium carbonate to lithium hydroxide conversion facility in Japan currently in ramp-up will join LTHM’s existing lithium hydroxide facilities in the USA and China. A further conversion facility at Quebec (Bécancour) is planned.

Growth profile: Along with assets currently in development, LTM’s brine assets have significant near-term expansion potential. Production capacity is now around 90ktpa Lithium Carbonate Equivalent and has potential to lift to around 250ktpa LCE by 2027.

Investment view – Buy, Target Price $12.10/CDI

LTM provides the largest, most diversified exposure to lithium in terms of mode of upstream production, asset locations, downstream processing and customer markets. It is a key large-cap leverage to lithium prices and sentiment, which we expect to improve over the medium term. The group has a strong balance and growth portfolio.