Downgrades FY23 guidance

AMA downgraded its FY23 normalised EBITDA guidance from $70-90m to $60-68m (vs BP forecast $71m) and cited “ongoing margin compression” as the key reason which was driven by labour constraints, higher employee costs and many contracts not containing appropriate adjustment mechanisms from inflation and/or repair severity. The company added that it will “confirm or update FY24 guidance upon the earlier of finalisation of the outcome of Capital SMART repricing or at FY23 results”. AMA also released its Appendix 4C for 3QFY23 and the key take-outs were: operating cash flow of $0.3m; continued upward trend in underlying cash flows over first three quarters; investing cash flow of negative $5.5m; and cash balance at 31 March of $20.5m. The company said covenant testing requirements were satisfied at 31 December and are also expected to be satisfied at 31 March.

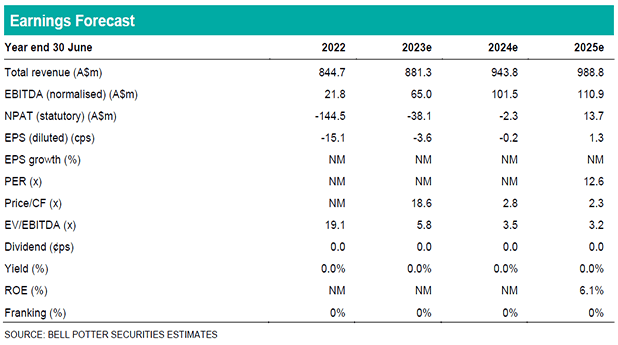

EBITDA downgrades of 7-8%

We have downgraded our normalised EBITDA forecasts in FY23, FY24 and FY25 by 8%, 7% and 7%. We now forecast FY23 normalised EBITDA of $65m which is well within the updated $60-68m guidance range. We also now forecast FY24 normalised EBITDA of $102m which is still below the current $120-140m guidance range and so continue to believe there is downside risk to next year’s guidance. We now expect a cash balance of c.$25m at 30 June 2023 and do not assume a capital raise in our forecasts though this now cannot be ruled out.

Investment view: PT down 18% to $0.28, Maintain BUY

We have updated each valuation used in the determination of our price target for the earnings changes as well as market movements and time creep. There is no change in the 3.75x multiple we apply in the EV/EBITDA valuation but we have modestly increased the WACC in the DCF from 11.3% to 11.4% due to the current macro environment and an increase in the cost of debt. The net result is an 18% decrease in our PT to $0.28 which is still a material premium to the share price so we maintain our BUY recommendation.