Modest upgrades

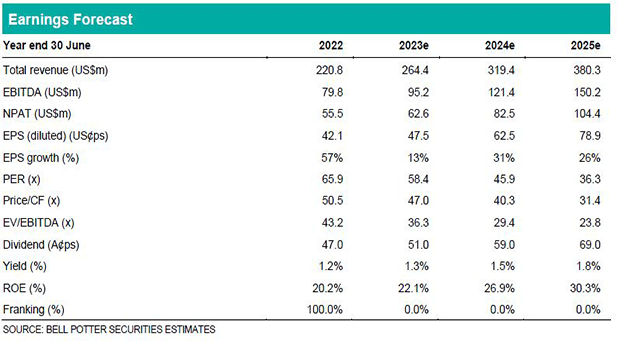

We have reviewed our forecasts post the release of the FY22 result last month and put through modest revenue and EBITDA upgrades of 1%, 2% and 3% in FY23, FY24 and FY25. The upgrades have mainly been driven by increases in our subscription and maintenance revenue forecasts given this was the area that positively surprised in the FY22 result and the strong growth looks set to continue with solid increases in the average price for software seats on subscription. We now forecast FY23 revenue and EBITDA margin of US$264.4m and 36.0% which are still within the guidance ranges of revenue b/w US$255-265m and an EBITDA margin of b/w 35-37%. We also now forecast FY26 revenue of US$448.1m which, however, is still short of Altium’s aspirational target of US$500m in this period.

PT up 7% to $40.00

We have updated each valuation used in the calculation of our price target for the earnings changes as well as market movements and time creep. There are no changes in the key assumptions we apply which are no premium or discount in the relative valuations and a 9.0% WACC and 5.0% terminal growth rate in the DCF. The net result is a 7% increase in the PT to $40.00 which has been driven by relatively consistent increases of 6-7% in each of the three valuations.

Investment view: Downgrade to HOLD

At our updated PT of $40.00 the expected excess return is <15% so we downgrade our recommendation to HOLD. We continue to be positive on the outlook for Altium but now see the stock as around fair value trading on an FY23 EV/EBITDA and PE ratio of 36x and 58x. We also see a lack of short term potential catalysts for the stock given Altium does not tend to make many announcements outside of results and we do not expect the company to upgrade its guidance at the AGM in November given it will still be relatively early in the financial year. In our view the key risk to our downgrade is the company makes an accretive and/or strategic acquisition of reasonable size which seems a possibility especially with the strong Balance Sheet.