Another downgrade

Major takeaways from UMG’s recent trading update are:

FY22e EBITDA Guidance: FY22e EBITDA guidance has been downgraded from $115-140m to $100-108m on a pre-SaaS basis (costs estimated at $13m). The main drivers of the downgrade are in the processing division with continued margin pressure from higher barley prices and continued delays in customer shipments.

FY23e EBITDA Guidance: Initial FY23e EBITDA guidance of $140-160m has been provided, this is below our previous range of expectations of $150-180m. 1H23e EBITDA pre-SaaS is forecast at $58-66m (1H21 $57.3m), with 2H23e EBITDA pre-SaaS forecast at $82-94m.

Balance sheet: FY22e Net debt /EBITDA is expected to temporarily exceed UMG’s 2.0-2.5x target. UMG does not anticipate the need to raise equity.

Earnings drivers: Our analysis of export data continues to demonstrate a recovery in malt trade flows from the largest producing regions and a general bottoming in implied malt-barley premiums. These are precursors to a recovery in earnings in our view. Energy futures while higher in FY23e, are materially lower in FY24e.

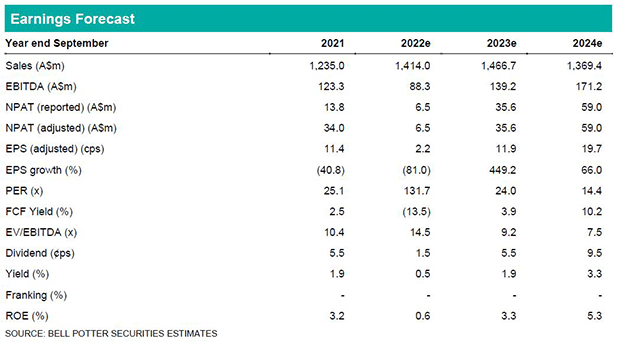

We have updated our assumptions around energy cost inflation, North American export volumes and processing margins. The net impact is NPAT downgrades of -78% in FY22e, -33% in FY23e and -9% in FY24e. We have also narrowed our target FY24e target EBITDA range from $170-210m to $160-190m in our EVA model resulting in our target price falling to $3.85ps (prev. $4.55ps).

Investment view: Buy rating unchanged

The central issue in UMG is whether there has been a structural erosion in processing margins over the past 18 months or whether the FY22-23e results are simply a reflection of malt pricing failing to keep up with a +20-30% YOY movement in regional barley prices at a time of energy cost inflation and supply chain issues (North American export volumes down ~20% YOY in 3Q22). We see the majority of the issues as cyclical in nature and as such our Buy rating remains unchanged.