Looking at trade flows and acreage

This is a compendium of crop protection trade flows and acreage information that we review as drivers of supply and demand in NUF’s core markets. Key takeaways:

Ag-chem volume to Australia: China, India and Japan account for ~65-70% of imports of herbicides, fungicides and insecticides into Australia. Our analysis of trade flows demonstrates a -8% YOY reduction in exports to Australia from these producers in Oct’21, but a +13% YOY uplift on a R3M basis, which removes monthly distortions.

Ag-chem volume flows to USA: China and India account for ~65-70% of imports of herbicides, fungicides and insecticides into USA. Our analysis of trade flows demonstrates a +140% YOY uplift in exports to the USA from these producers in Oct’21 and +135% YOY uplift on a R3M basis, which removes monthly distortions.

Ag-chem volume flows in EU: The majority of trade flows in the EU are from EU member countries. EU-intra data captures both imports from member states and other countries. Our analysis of the data illustrates a +12% YOY uplift in Aug’21 for the total EU and a +10% YOY uplift in NUF centric countries (France, Germany, Spain, Italy and Poland). On a R3M basis the YOY uplift is +6% and +6%, respectively. Of the NUF member states that have reported for Sep’21 (France and Spain), there is a +12% YOY uplift.

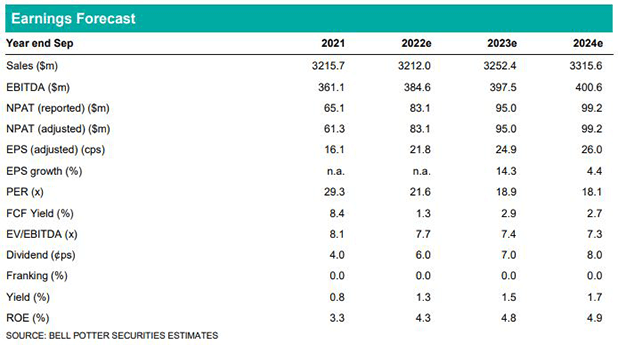

There are no changes to our forecasts or target price in this note. Our analysis of trade flows continues to demonstrate strong flows of ag-chem product to core NUF markets. In addition, at this stage, initial acreage, crop development and crop projections are generally supportive of demand in FY22e in core NUF markets.

Investment view: Buy rating unchanged

There is no change to our Buy rating. We see NUF as better placed to navigate a normalisation in Australian demand levels, given recovering acreages in North America and Europe. Beyond seasonal factors the creation of new revenue streams in oils and biofuels should emerge as a theme in FY23e and beyond.