On-Track

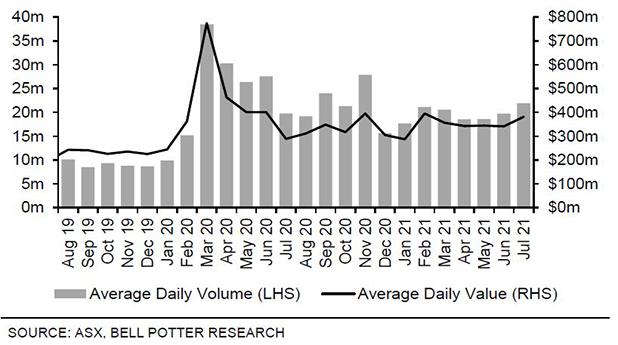

Tracking Difference and Tracking Error are two measures that can assist clients in evaluating the efficiency of a manager’s ability to replicate reference index returns.

- Tracking Difference: Measures an ETF’s performance against its benchmark index over an interval of time. Tracking Difference can be both positive or negative, and reveals the extent to which relative under or outperformance is achieved.

- Tracking Error: Measures the dispersion or variability of an ETF’s under or outperformance in respect to its benchmark index over an interval of time.

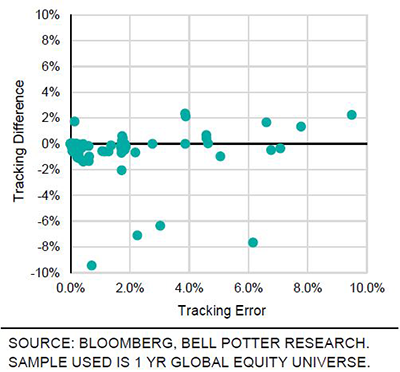

It’s important to note that factors such as benchmark turnover frequency, liquidity, fees, sampling methods, cash allocation and securities lending can have a push or pull effect on Tracking Difference. This is key for long-term investment horizons, however some short-term investors may preference low volatility and performance consistency, in which case such clients should also consider Tracking Error.

Figure 1 – Tracking Difference & Error

Figure 2 – Expense Ratio, Tracking Error

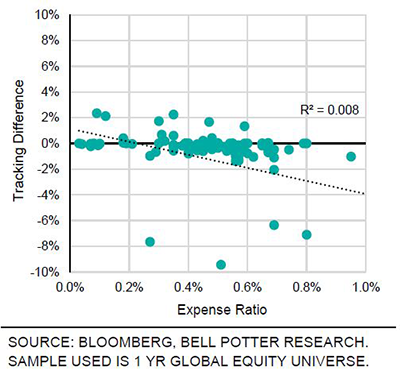

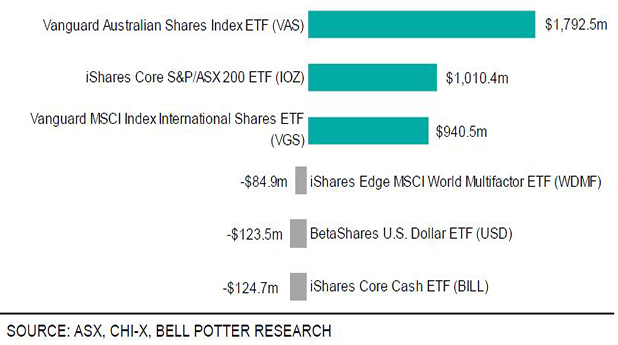

Figure 3 – Top ETF flows for July 2021

Figure 4 – Top ETF flows for 12 months ending July 2021

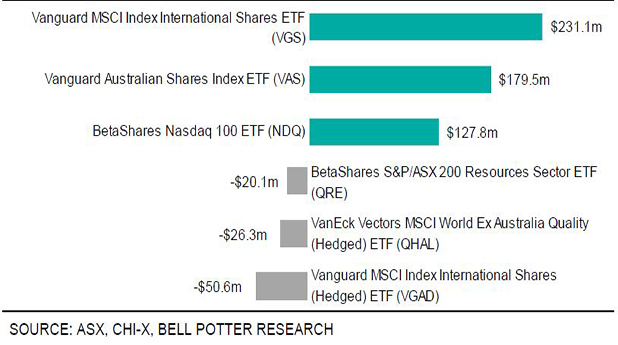

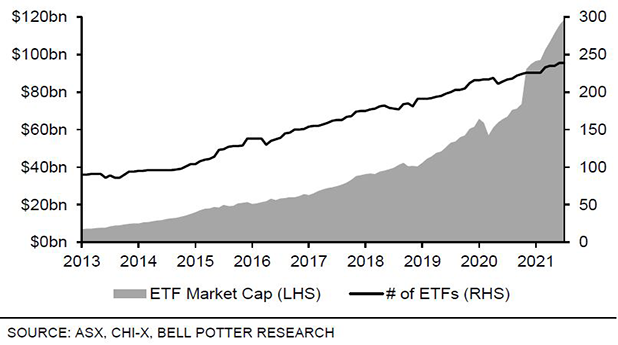

Figure 5 – ETF market size

Figure 6 – Average daily volume and value