Resilient YTD update broadly in line with BPe

Universal Store Holdings (UNI) provided a trading update for the first 17 weeks of FY26 at their AGM: group direct-to-customer sales of +13% on pcp, like-for-like (LFL) sales on pcp of +7.7% and +13.9% for key banners, Universal Store (US) and Perfect Stranger (PS) respectively. While some easing in growth rates was seen amidst challenging comps, gross margins (GM) were ahead of Consensus/BPe. Fixed cost investment to support capability and the FY26 new store guidance of 11-17 across the three banners were reiterated, with some early wins in 1H new stores.

Earnings changes

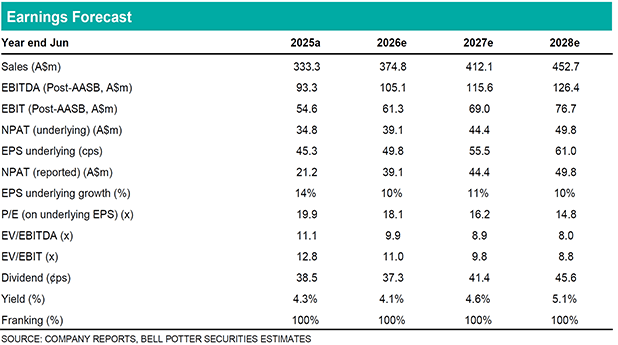

Our revenue estimates see some minor downgrades as we factor in a level of conservatism across the three retail banners and wholesale given the comps cadence in Nov-Feb ahead for the key Universal Store banner. We also see some improvements to our gross margin assumptions (FY26 +110bps on pcp) on the back of the strong update and as the PS brand’s contribution to the overall group increases (~8% of group sales). Our CODB % of sales assumptions see a further ~30bps increase in FY26e (FY26 +110bps on pcp) to see EBIT growth close to revenue growth at 12.5%. This sees our NPAT forecasts +0.7%/+0.4%/+0.1% for FY26/27/28e.

Investment view: PT unchanged at $10.50, Maintain BUY

Our PT remains unchanged at $10.50/share given the minor changes to our longerterm earnings. Our target multiple within our relative valuation remains unchanged at ~14x on a FY27e basis. At ~18x FY26e P/E (BPe), we see UNI trading at a discount to the ASX300 peer group and see the multiple justified by the distinctive growth traits supporting consistent outperformance in a challenging category, longer term opportunity with three brands, organic gross margin expansion via private label product penetration (currently ~55%) and management execution. While catalysts associated with further interest rate cuts for Australia in CY25 are not imminent post the third rate cut in Aug, we continue to see the youth customer prioritising on-trend streetwear and expect UNI to benefit with their leading position. Maintain BUY.