Company background

Generation Development Group (GDG) is a financial services company that provides a range of tax-effective investment solutions, annuities, managed accounts and research services. GDG reported a transformative FY25 result with NPAT up +500% on the pcp to $30.2m, reflecting the full benefit of Lonsec and partial year earnings from Evidentia. Integration advanced well with EBITDA margins being the highlight of the result. Other than that, the heritage business continues to deliver with +26% pa compound growth in funds under management since FY19 to exceed $4.4bn. Whilst this is a mature and small market, what has changed is the legislative environment. If passed into law, the current proposed tax would levy an additional 15% on earnings from superannuation balances over $3m. This is creating greater product awareness and sales momentum for GDG. We believe that incremental flows from superannuation could be a $300bn opportunity; and see potential for strong results to come. GDG has made significant inroads as a business over the last decade, accelerating in the LTM. The recent $25m minority investment from BlackRock is supportive of our view that commercial success in the retirement or decumulation market could be radical. This is a long-term interest with seed capital locked up for 5-years – set to fund a product launch targeted for the coming year. This is BlackRock’s first strategic balance sheet investment in Australia.

Managed accounts the crown jewel

GDG principally operates an asset-based fee model, built on parallels driving success in other wealth management companies. Key components include strong inflows, low outflows and market appreciation. The main drivers of growth will come from capturing an outsized share of the managed accounts market, which is expected to double shy of $500bn by FY30E. Lonsec has a successful track record in a fragmented market. Consolidating Evidentia, GDG holds leading market share of 10%. We expect margin expansion through acquisition cost synergies and scale, helped by FUA conversions.

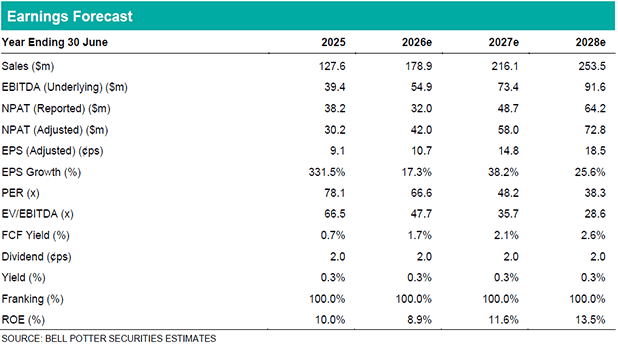

Investment view: Initiate coverage with a Buy; $8.20/sh

We initiate coverage on GDG with a Buy rating and $8.20/sh target. GDG screens well with significant growth runway, trading on a PEG -10% below tech and financial peers.