Orica: More than just an explosives supplier

ORI is a leading solution provider to the global mining and infrastructure markets. These solutions include the manufacture and supply of explosives, blasting systems, speciality mining chemicals (sodium cyanide and emulsifiers) and the provision of orebody intelligence, geotechnical and structural monitoring products and services. ORI has undergone a strategic pivot in recent years, transforming the company (through acquisitions) into a more diversified product and service provider, with emerging Speciality Mining Chemicals (SMC) and Digital Solutions (DS) segments to complement legacy Blasting Solutions (BS) operations. ORI expect to deliver an 80% / 20% EBIT split for Blasting / Beyond Blasting in FY25, compared with 86% / 14% in FY23, with aspirations declared to reach parity (50% / 50%; no timeline announced).

All segments set to deliver EBIT growth in the near-term

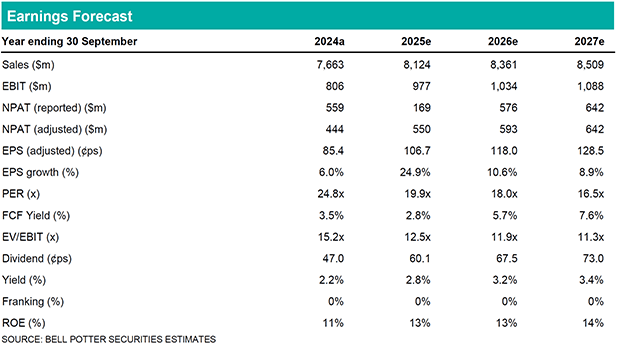

All segments set to deliver EBIT growth in the near-term ORI’s Sep’25 Business Update outlined a continuation of positive momentum in 2H FY25, leading the company to guide for higher earnings across the three segments compared with the PcP. Looking forward, we expect current operating momentum to continue in FY26-27 underpinned by: 1) strong uptake rates of high-margin premium blasting products; 2) favourable price realisation for ANFO and emulsion sales following successful re-contracting in tight market conditions; 3) higher AN (equivalent) sales due to increased run-of-mine material movement (from growing mineral and quarrying production volumes and increasing strip-ratios); 4) expanding EBIT margin at SMC as Winnemucca plant production lifts, driving operating leverage benefits and favourable mix movements towards own sodium cyanide sales; 5) a recovery in exploration activity from Major and Junior clients; and 6) continued conversion of cross-selling opportunities across the Digital Solutions businesses.

Investment thesis: Initiate with Buy; TP$23.00/sh

We expect ORI to grow underlying EBIT across each segment in the short-to-medium term. ORI is well positioned to deliver rapid de-leveraging over FY26-27 (in the absence of M&A), with scope for capital management to prioritise increasing shareholder returns via an extension to the share buy-back program and dividends.