Delta is not the only driver

Continued ACCC delays on the proposed Delta transaction is in our view masking improved pricing trends and seasonal outlooks in the base business. Key points below:

ACCC Delta delays: The ACCC has again delayed the Delta acquisition decision. A final decision was due 21/08. That timeline is now being altered to consider information provided by the parties, with no fixed time provided.

Livestock drivers: Since updating ELD in Jun’25, we have seen material gains in livestock prices, up: +15-27% in sheep and cattle markets. Spot livestock price indicators are now up +40% YOY in trade lamb, +93% YOY in mutton, +23% YOY in the EYCI and +22% YOY in the NYCI. The implied starting run rate for the value of livestock turn off is looking higher than we had previously assumed for FY26e.

Crop inputs: Since Jun’25, we have seen a material uplift in crop input values, with urea up +26%, DAP up +16% and Glyphosate tech up +10% in AUD terms. At the same time, recent rainfall has seen soil moisture profiles recover, three-month rainfall outlooks have improved and the BOM has indicated a likely earlier than normal northern wet season onset in QLD and NT.

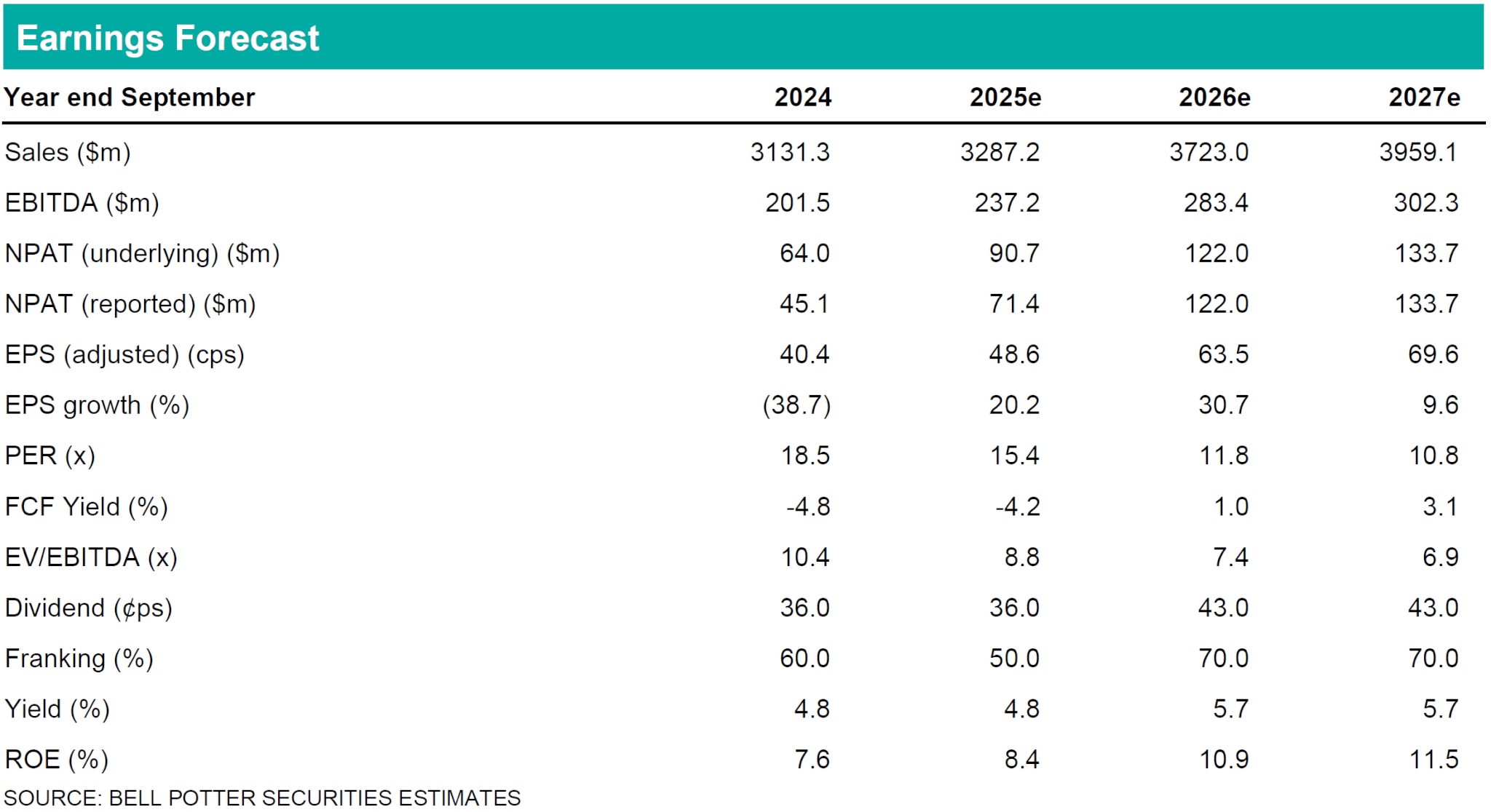

While we see a reasonably high probability Delta proceeds, the timing of completion is creating volatility in FY26-27e forecasts and we remove its contribution until formal ACCC clearance is received. In conjunction with this move, we have updated FY26- 27e seasonal drivers and DRP share issues. The net impact is modest EPS changes of -1% in FY25e and -3% in FY26e. Our target price is lifted to $9.45ps (prev $9.10ps).

Investment view: Buy rating unchanged

Our Buy rating is unchanged. We view the drawn-out Delta ACCC saga as masking the material improvement in the baseline drivers of the ELD business as we approach FY26e, those being: (1) a material acceleration in crop input and livestock pricing indicators; and (2) an improved 2H25-1H26 seasonal outlook. We forecast CAGR double digit EPS growth to FY27e on baseline drivers, with Delta having the scope to be ~10% accretive to FY26e EPS.