First half ahead of BPe

EOS released unaudited results for 1H24, detailing a better-than-expected start to the year. EOS recorded 1H revenue of $142.6m, which was +92% on 1H23 and represented 59% of BPe CY24 revenue ($241.1m). We believe the strong 1H result was likely the due to the acceleration of revenues from the 2H into the 1H, rather than any additional contract awards. The cash flow result was slightly weaker than anticipated, with the gross contract asset increasing to $89.7m and the $20.5m debt repayment contributing to a reduced cash balance of $52.2m.

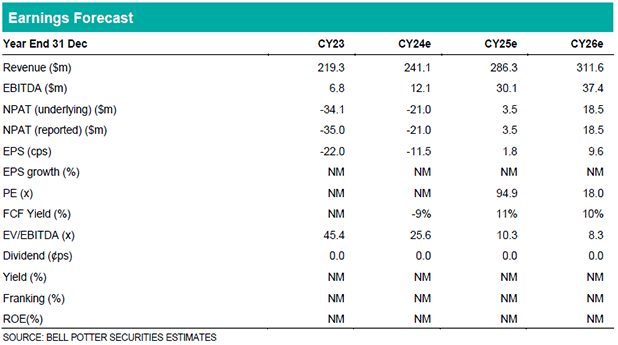

Minor changes to forecasts

We have made no changes to our CY24 revenue forecast ($241.1m) and expect a softer 2H due to certain revenues being recognised earlier in the year. We are comfortable our full-year forecast is covered by the current orderbook, so any risk to our estimates is likely to the upside based on the potential for new contracts awarded in the 2H. We have updated our working capital forecasts and corresponding cash flows in-line with the announcement, and we expect improved cash flow results in 2H24 and 1H25. Our CY24e EBITDA forecast remains unchanged ($12.1m) and we continue to forecast a return to profitability in CY25.

Investment view: PT up 5% to $2.20, retain BUY

Over the past 2 years EOS has consistently performed ahead of expectations and this 1H result again provides a strong foundation for the remainder of CY24 and de-risks our full-year forecasts. The focus for the remainder of the year will turn to growing the

order book, with particular focus on the conversion of the Ukraine contracts to unconditional purchase agreements and further RWS sales into Europe. We await further information on the 1H result from the Appendix 4c to be released later this month and the audited 1H24 results to be released in late August.

We increase our price target by 5% to $2.20, which a >15% premium to the current share price so we maintain our BUY recommendation.