Oilseeds, basis and crops

In this note we review the most recent indicators for GNC near term and the attractiveness of expanding oilseed crush capacity in the medium term in light of through the cycle canola acreage and production expansion. Key points:

Near term drivers: Soil moisture and three-month rainfall outlooks remain below average. However, the CSIRO wheatcast model continues to project wheat yields in NSW (+10%) and VIC (+14%) above the 15yr average. Wheat basis has contracted, though is still in a stronger position (from a GNC perspective) than in FY18 and oilseed crush margins remain elevated by historical levels and at levels that would imply an FY24e outcome broadly consistent with the FY22-23e average.

Oilseed investments: Recently Cargill announced a A$70-75m investment to add ~100kt of capacity across three sites and GNC announced it has commenced evaluating the case for new crush capacity. When viewed in the context of a +25% uplift in canola acreage over the last decade and +74% growth in canola production (on a R5Y through the cycle basis) resulting in a growing exportable surplus we would expect any investment in new capacity is likely to be reasonably attractive from an earnings stand point.

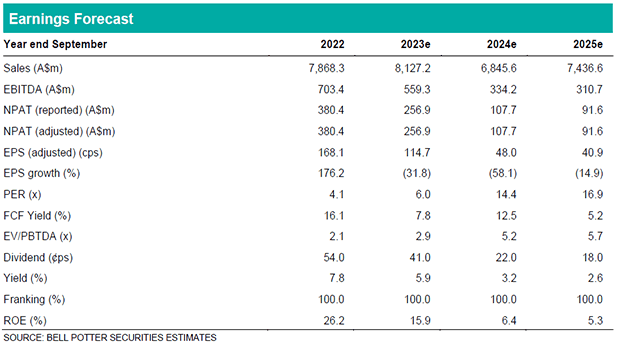

We have reviewed our forecasts in light of recent movements in grain basis and oilseed crush margins, this results in EPS changes of -3% in FY24e and +4% in FY25e. Our FY25e forecasts have down risked canola crush margins from implied FY25e futures levels. Our target price is unchanged at $9.45ps.

Investment view: Buy the dry

Our Buy rating is unchanged. When we consider the uplift in baseline PBTDA and improved corporate net cash position GNC is already trading at levels consistent with the previous seasonal lows. Trading at 5.5-6.2x through the cycle PBTDA, valuation is undemanding, with multiples likely to contract further as cash is released in lower crop volume years (i.e. unrealised trading cash earnings and lower working capital).