Forecasts tweaked, little overall change

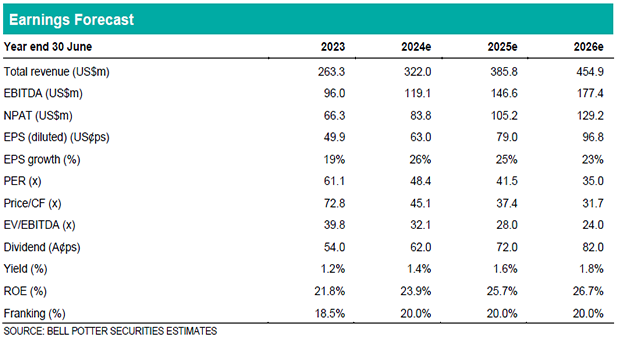

We have revised our forecasts for Altium post the release of the FY23 result last month and have made some modest changes including: revenue upgrades of c.1% driven by higher design software revenue partially offset by lower cloud platform revenue; NPAT upgrades of c.1% driven by the revenue upgrades with no change in our margin forecasts; and negligible change in our EPS forecasts as an increase in our forecast number of fully diluted shares has wholly or largely offset the impact of the NPAT upgrades. We now forecast FY24 revenue of US$322.0m (vs US$320.4m previously) which is still within the guidance range of US$315 325m albeit more towards the upper end. (Our design software and cloud platform revenue forecasts of US$252.6m and US$69.4m (vs US$248.5m and US$71.9m) are now also consistent with the guidance of US$250-255m and US$65-70m.) As mentioned, there is no change in our EBITDA margin forecast of 37.0% which is at the top end of the 35-37% range. We also now forecast FY26 revenue of US$454.9m (vs US$450.5m previously) which is still below the company’s aspirational target of US$500m.

Investment view: PT up 10% to $44.00, Maintain HOLD

We have increased the multiples we apply in the PE ratio and EV/EBITDA valuations from 45x and 25x to 50x and 27.5x and reduced the WACC we apply in the DCF from 9.4% to 9.0% given the upgrades in our design software revenue forecasts which we view as higher quality given its stickiness and/or recurring nature. The net result is a 10% increase in our PT to $44.00 which is still a modest discount the share price so we maintain our HOLD recommendation. Intuitively, we believe the stock looks around fair value trading on an FY24 PE ratio of c.48x which is higher than Technology One on c.42x but still well below WiseTech Global on c.82x. Like-for-like comparison with these peers is difficult due to different accounting practices (i.e. Altium expenses everything while both Technology One and WiseTech capitalise around 50% of their R&D) but in our view Altium and Technology One should trade on broadly similar multiples given the positive of being a global software company is largely offset by being very early in its transition to SaaS.