Perenti to acquire DDH

Perenti (PRN; not rated) and DDH have announced that they have entered into a binding Scheme Implementation Agreement (SIA) pursuant to which PRN will acquire 100% of the fully paid ordinary shares in DDH. Under the SIA, DDH shareholders can elect maximum scrip or cash alternatives (subject to scale back based on a total cash offering of $50m), with the formal consideration being $0.1238 cash and 0.7111 PRN shares per DDH share held. The consideration implies an initial acquisition price per DDH share of $1.01 (based on PRN’s 5-day VWAP leading up to the SIA announcement). Post deal completion, PRN and DDH shareholders will own 71% and 29% of the diluted share capital of the combined entity, respectively. The DDH Board has unanimously recommended the Scheme, so have Oaktree, Matt Iznet, Richard Bennett and Kent Swick, indicating Scheme support across ~38.0% of DDH’s equity share base. The deal is subject to ASIC registration and Court approval, and other standard conditions precedent. DDH shareholders are scheduled to vote at a Scheme meeting in September 2023, with Scheme implementation targeted by October 2023.

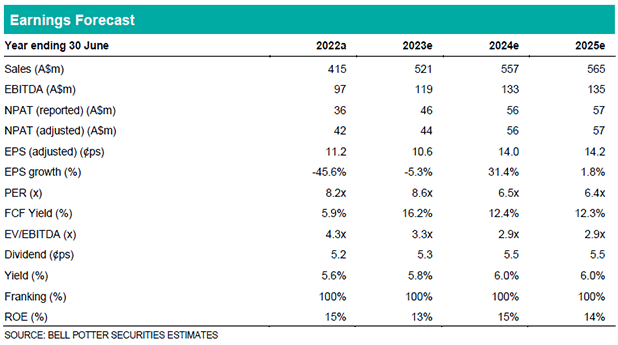

DDH also provided a FY23 earnings update: underlying EBITDA is expected to be within $117-121m (BPe old $128m). The earnings update reflects a continuation of weak operating conditions since early January 2023 due to delayed customer drilling program commencements and regulatory approvals, and wet weather. On a positive note, utilisation and revenues are improving in Q4 FY23 as customer drilling programs recommence. In this report, EPS downgrades reflect this weaker than expected operational update: -12% FY23; -3% FY24; and nc FY25.

Investment view: Hold (prev. Buy), TP$0.94ps (prev $1.20ps)

In light of the binding SIA to acquire 100% of DDH’s fully paid ordinary shares, we downgrade to Hold (previously Buy), with our Target Price set at the current implied acquisition price of $0.94 per DDH share. The implied price values DDH at 3.4x FY23 EBITDA (BPe). This valuation multiple is larger than those of comparable, capital-intensive mining services companies on the ASX.