Reaffirms guidance

WiseTech held its AGM today and reaffirmed its FY26 guidance of revenue b/w US$1.39-1.44bn, EBITDA b/w US$550-585m and EBITDA margin b/w 40-41%. The company also flagged that the new commercial model will go live on 1st December and “a large number of customers” are expected to transition on that date. There was, however, little update on the launch of Container Transport Optimisation (CTO) with only the comment “we are focused on our initial launch of CTO with revenue generation commencing during the year”. WiseTech also flagged its upcoming investor day on 3rd December and said it will provide details on “the rollout of our new commercial model, and progress relating to CTO and the e2open integration”.

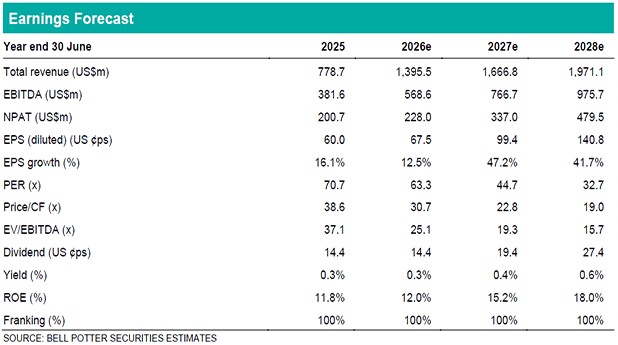

Modest EBITDA downgrades of 1-2%

We have modestly downgraded our EBITDA forecasts in FY26, FY27 and FY28 by 1%, 2% and 2% mainly for conservatism. The downgrades have been driven by 2-3% reductions in our revenue forecasts which has been partially offset by increases in our margin forecasts. In FY26 we now forecast revenue and EBITDA of US$1.40bn and US$569m which is towards the lower end of the guidance range for the former and close to the middle for the latter. That is, we see more risk at revenue than EBITDA this year, particularly with the greater-than-usual revenue skew to H2. Any weakness or miss at revenue, however, we would expect to be offset by a stronger margin.

Investment view: PT down 22% to $100, Maintain BUY

We have reduced the multiples we apply in the PE ratio and EV/EBITDA valuation from 115x and 52.5x to 90x and 42.5x with the recent de-rating of the tech sector and reduction in multiples applied. We have also increased the WACC we apply in the DCF from 8.3% to 8.4% for the same reason. The net result is a 22% decrease in our PT to $100 which is still >15% premium to the share price so we maintain our BUY recommendation. The next potential catalyst is the upcoming investor day and, in particular, any details around the launch of the new commercial model. A high uptake of the CargoWise Value Pack, for instance, would be bullish in our view.