Leader in Developing Scientific Analytical Tools

TRJ is a developer and manufacturer of analytical science instruments, devices and solutions, focusing on accessing specialist skills and capabilities that improve the analytical workflow of the global life sciences industry. The product portfolio consists of three segments: Components & Consumables, Capital Equipment and Disruptive Technologies. The first two divisions focus on workflows, which are ultimately used in the analysis of clinical, biological, food and environmental samples.

Blue-Chip Customer Profile

TRJ partners with a range of blue-chip customers across multi-national OEMs, pharmaceutical companies, CROs, food testing companies and scientific distribution companies. TRJ collaborates with its partners on technology development programs, and this ensures that TRJ’s components are embedded within its customer’s instruments. This creates long-term stability in TRJ’s revenue profile. TRJ’s international infrastructure footprint ensures it can service this global customer base.

Earnings Normalising

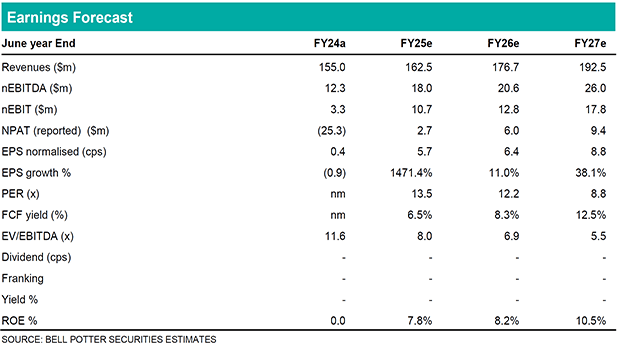

Following the industry de-stocking phase post the COVID-19 pandemic, we assume that TRJ can return to a consistent high-single-digit revenue and low-double-digit earnings growth profile. M&A has been a historical feature and with net leverage reducing to c.1.7x for FY25e, acquired growth could soon return to support earnings.

Investment View: Initiate with a Buy. TP $1.50 / sh

We apply a blended valuation across DCF (WACC 12.5%) and EV/EBITDA (1-yr fwd10x). TRJ provides investors with unique exposure in an ASX context to the global analytical life science tools & instruments industry that is defensive in nature. TRJ offers deep value given it is trading at a c.47% discount to close peer Tecan and a c.60% discount to major US peers. TRJ should garner greater investor attention as it returns to sustainable double-digit growth.