Tilt into change

We see value for alternatives to long Treasuries that can be derived by combining a number of stylised Exchange-Traded Funds (ETFs).

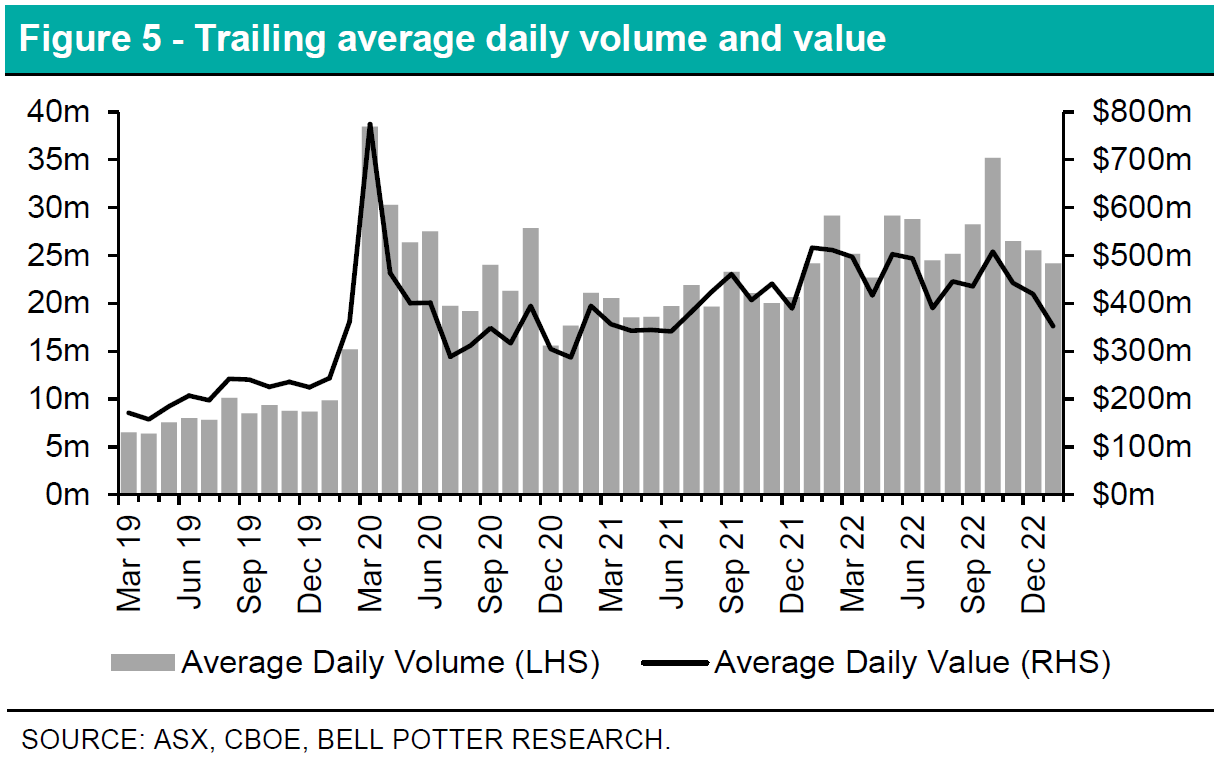

An allocation to long Government Treasuries has played a historic importance across multiasset portfolios, where they have pivotally functioned as a source of moderate yet stable total returns, with an important ballast to equity risk. Recent transitions from ultra-accommodative monetary policy settings globally, however, is beginning to undermine this cornerstone lever of portfolios as asset malaise becomes more widespread and correlated.

With inflation being the key driver of this and policy settings in response to such phenomena tightening, a substitution away from long-duration Government securities, that can only be achieved through uniquely available ETFs, could provide for the following benefits in the near-term:

- Lower drawdown risk;

- Insulated real income returns;

- And combining the two, superior risk-adjusted returns.

Figure 1 – S&P 500 and US Treasuries, rebased to 100

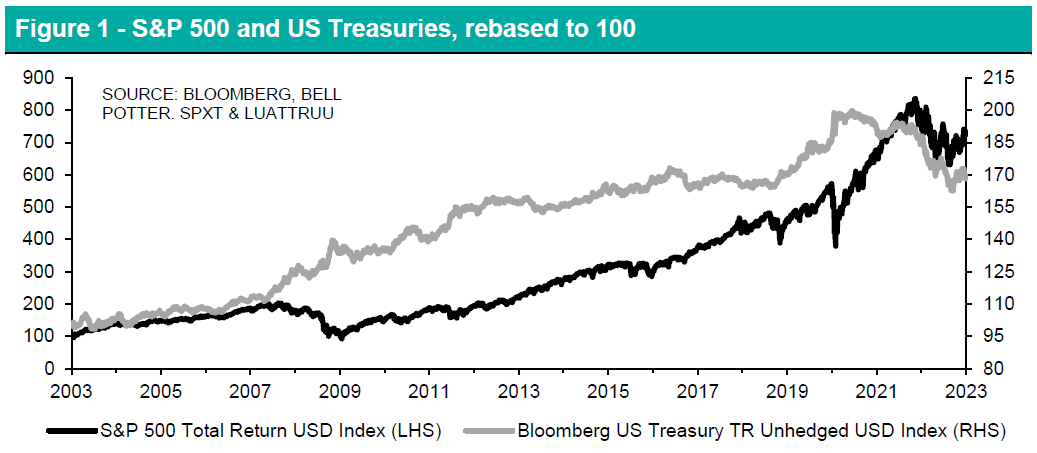

Figure 2 – Top ETF flows for January 2023

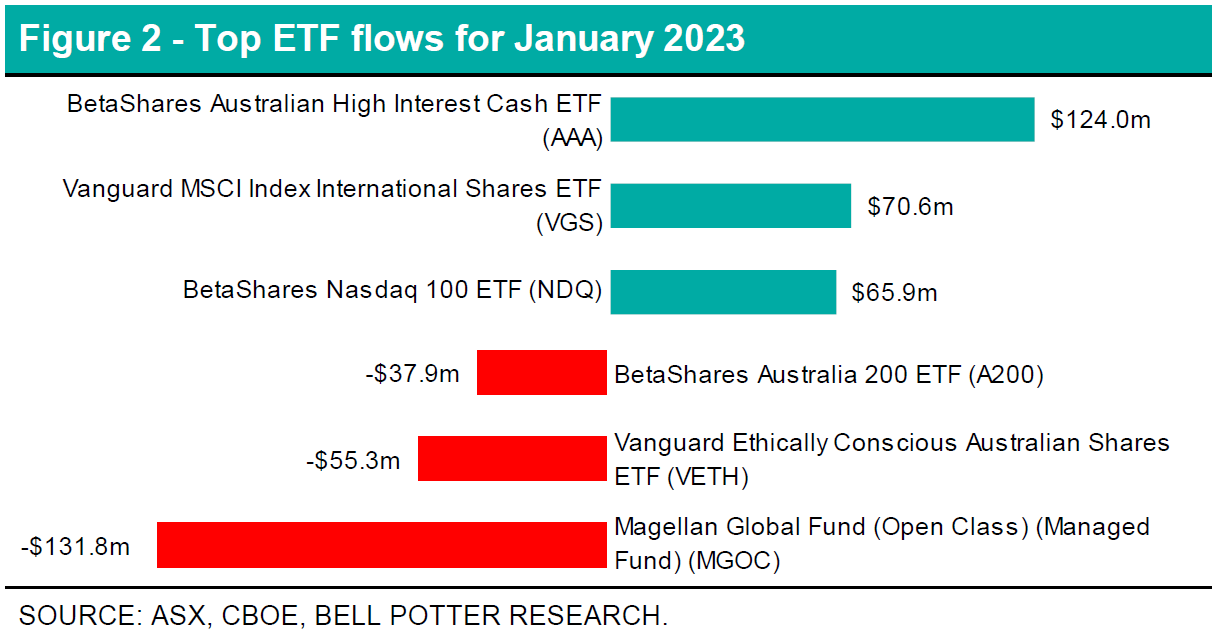

Figure 3 – Top ETF flows for 12 months ending January 2023

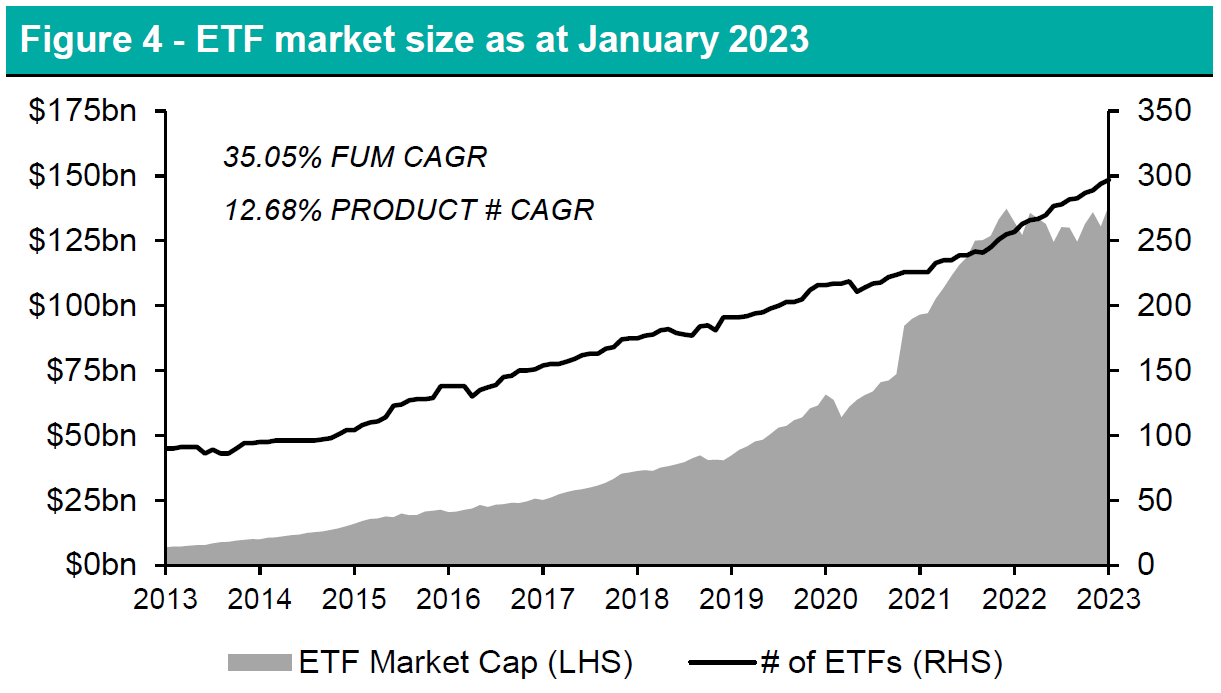

Figure 4 – ETF market size as at January 2023

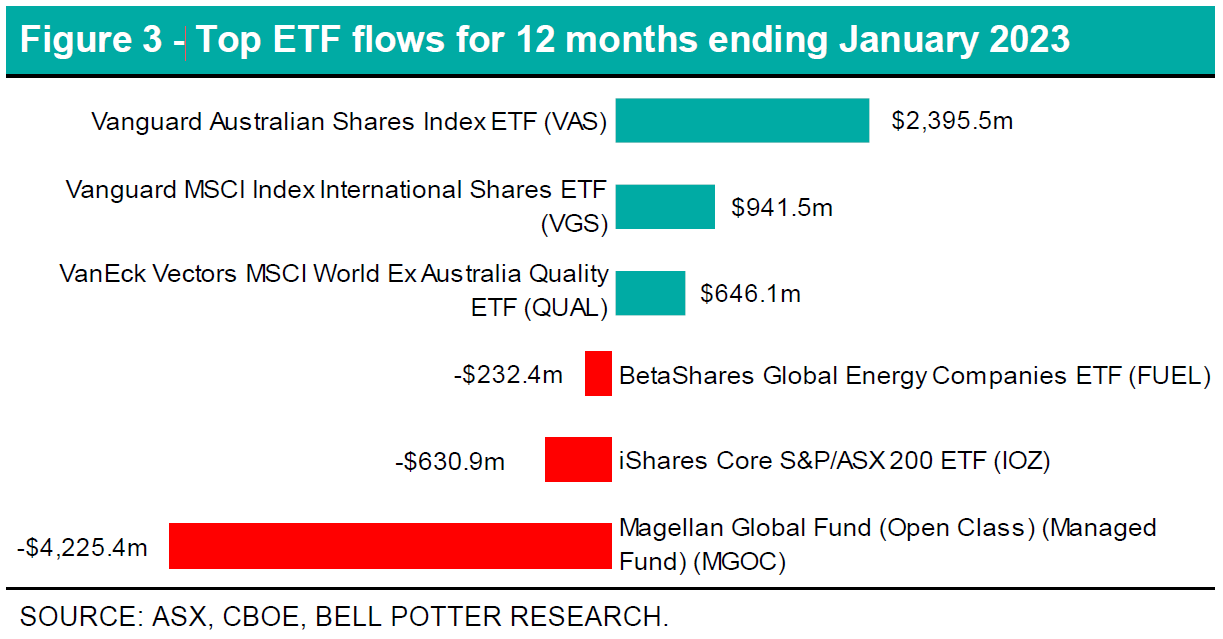

Figure 5 – Trailing average daily volume and value