Shipments biased to the 2H

SM1’s recent trading update highlighted delays in shipping timelines of ingredients, shifting revenue and profit recognition from 1H23e to 2H23e. Key takeaways:

Ingredients shipments: SM1 has experienced shipment delays of Ingredient products (down ~45%) due to the implementation of SAP and lower milk supply in the first 4mths of FY23e. The monthly ingredient export run rate is back to near-normal levels in Dec’23 and expected to be entirely caught up at the start of 4Q23.

Reduced Lactoferrin volumes: Lactoferrin volumes are down -40% YOY, due to sales phasing (diversion of Lactoferrin to A2M PRC label IMF ahead of Feb’23 and seasonal bias). FY23e Margins are expected to be equal to or better than FY22 levels.

Non-recurrence of FX benefit: SM1 gained NZ$12-15m in FY22 from a favourable FX hedge position, with the majority of this booked in 1H22.

Exclusive of the trading update, we are witnessing continued favourable IMF export volumes from SM1 accessible ports, above average premiums for ingredients relative to GDT outcomes at SM1 accessible ports and a beneficial premium of AMF to butter.

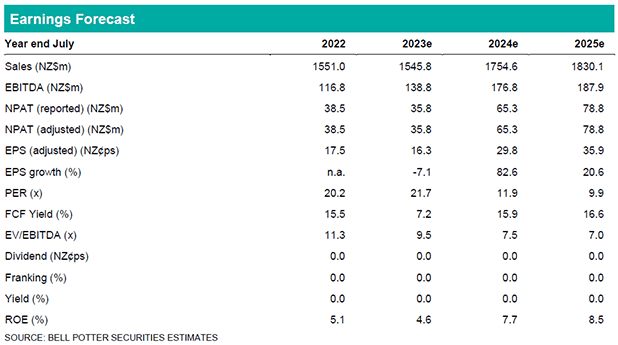

Following the update our EBITDA forecasts are largely unchanged. However, we have downgraded NPAT by –6% in FY23e, and -2% in FY24e to reflect higher interest rates and higher average net debt balances in FY23e (reflecting slower sales timelines and the working capital implications). We lift our target price to A$4.00ps (prev. A$3.60ps) largely reflecting time creep.

Investment view: Buy rating unchanged

Our Buy rating is unchanged. The optimisation of capacity from ingredients towards nutritionals and valued added products results in a favourable margin gain for SM1, while also accelerating deleveraging (pre-payments and utilisation of assigned receivable facilities for IMF). This combination of operating leverage and balance sheet deleverage is likely to emerge as key driver of future share price direction, that is likely to be more pronounced as we enter 2H23e.