1H24 result top of range; performing well in a tough market

SUM announced its 1H24 result with underlying profit of NZ$89.9m, at the top end of the guidance range (NZ$87-$90m), slightly ahead of both BPe (+1.6%) and VA consensus (+1.2%). No full year profit guidance, but equally no change to SUM’s target for 675-725 new homes under ORA in CY24. Key takeouts include:

(1) Deploying capital into new sites – SUM has acquired a new site at Mission Hills, Napier for c.300 units (pricing undisclosed) which is ‘shovel ready’ and where it has market visibility as its 5th village in the Hawke’s Bay region.

(2) Aus out of the ground – Delivered first settlements at Cranbourne North as Australia becomes a key go-forward pillar. Elsewhere, village at Chirnside Park is underway, Sum is hoping to commence Oakleigh before end CY24 and the business continues to look at opportunities particularly in QLD.

(3) Cost out in progress – SUM estimates it has reduced operating costs by $10-15m pa, which should see 2H reducing c.$5m.

Earnings changes: small changes

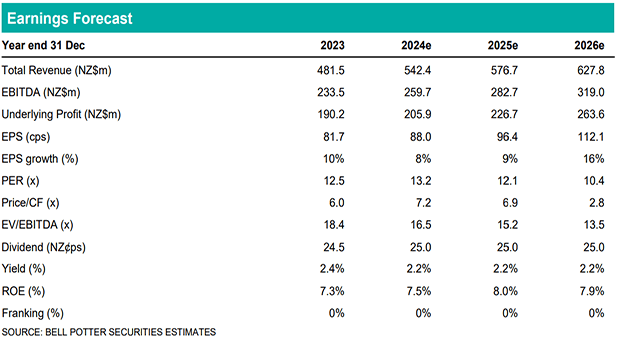

We adjust our FY24-26 EPS estimates by -2% to +1% reflecting (1) variable debt outlook; (2) trimmed development deliveries (BPe 680 vs. 675-725 target); and (3) impact of half year actuals. Our target price increases slightly accounting for these earnings changes, and roll forward of our valuations. Our TP is based on 50/50 blend of our SOTP and DCF valuations.

Investment view: No change to our Buy rating

Despite a challenging economic and housing environment in NZ, SUM has posted a modest profit increase y/y, and driven total settlements (new and resales), +22% y/y. With prior guidance for 675-725 new homes maintained, and recent take-private interest in the sub-sector (Stonepeak bid for Arvida at +65% premium to undisturbed price), we think SUM is well positioned to grow from here as NZ-based headwinds turn into tailwinds with lower cash rate profile, improved buyer confidence and strategic capital remains attracted to the sub-sector.