Contract update: Awards reflect diverse & quality clients

Contract update: SRG has announced several contract awards with existing, repeat clients in the Water, Transport, Health, Resources and Dairy sectors across Australia and New Zealand, totalling $700m in value. The value of new contract awards and extensions in FY25TD is $925m (vs $475m in the PcP; and $785m+ in FY24), representing one of the largest contract updates in the company’s recent history. This update highlights the diversity of SRG’s operating model, servicing clients in multiple industries and geographies, which should protect overall Group activity from underperforming sectors. We are also encouraged by the Diona contracts, which should expand work-in-hand from $1.0b (at the time of acquisition), and underlines the recurring nature of project delivery by Diona.

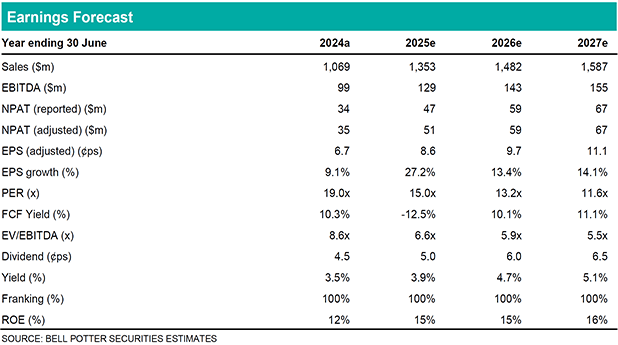

Greater confidence in outlook: These contracts are a representation of the company’s significant skew towards recurring-style work (80% of Group EBITDA; pro forma FY24). In addition, several contracts were secured with a 5+ year term (some with extensions), highlighting continuity and visibility of workflow in the medium-to-long term. Following this update, we have greater confidence in our short to medium term earnings growth outlook. We are forecasting 18.1% EPS CAGR over FY24-27.

Upside risk to FY25 guidance: Our updated FY25 EBITDA forecast of $128.5m is 2.8% ahead of guidance. We emphasise an upward bias to our updated forecast, outlining that management’s historical guidance beats have typically ranged 3-15%.

EPS changes: Reflects our upgraded revenue growth and EBITDA margin forecasts for the Maintenance & Industrial Services segment (including Diona): +1% FY25; +6% FY26; +6% FY27.

Investment view: Buy; TP$1.55/sh (previously $1.40/sh)

Today’s contract update highlights the diversity and quality of SRG’s client base across multiple end-markets, while emphasising a strong tilt towards recurring work. Pleasingly, SRG’s valuation gap with the Industrial Services peer group has closed; we argue SRG should trade at a premium given its above average EPS growth outlook.