Global Pathology Leader

SHL is a global Pathology company operating in several European markets as well as Australia, US and NZ, holding leading positions in Australia, Germany, Switzerland, UK, Belgium and the #3 position in the US. Pathology is an essential healthcare service with mandated growth, but the international network has been developed over decades via dozens of acquisitions in select markets. Pathology comprises of c.85% of group revenue, followed by the 3rd largest Australian radiology business (by number of clinics / radiologists, but 2nd largest by market share) comprising c.10% of revenue and the balance via a domestic clinical services business.

FY25 – Moving Beyond the COVID Hangover

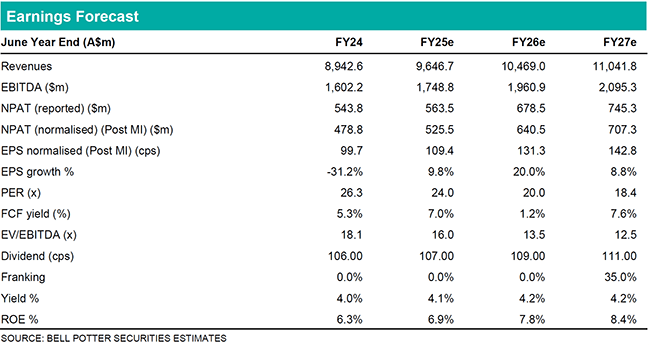

SHL should return to growth, with c.7.9% / c.9.1% / c.9.7% revenue, EBITDA and Normalised NPAT growth. We expect EBITDA margins to begin to recover in FY25 and deliver c.110bp improvement through to FY27. Growth is being driven by right sizing the business, the impact of acquisitions in FY24 and normalising organic operations post COVID. Our estimates are broadly in line with consensus.

Innovation Drives Future Growth

Between PathologyWatch and Franklin.ai, SHL is setting the scene for speeding up diagnostic processes and improving diagnostic accuracy. While genetic testing is <10% of revenue now, expected CAGR of c.22% over the next decade is expected to drive material improvement in performance over time.

Investment View: Initiate with BUY, TP of $33.70 / sh

We adopt a blended valuation across DCF, EV/EBITDA & PE methodologies. The TP represents a c.28% premium to the current price, in addition to an expected dividend yield of c.4%. SHL typically trades at a c.27% premium to the XJO, but this has narrowed to c.13%. Short-term catalysts include completing the LADR acquisition and the forthcoming FY25 results to at least meet consensus expectations.