Updating model for Boral acquisition

With the Boral (BLD) acquisition nearing completion, we revisit our SVW model forecasts, updating our attributable SVW financials, BLD valuation and SVW’s capital structure post-acquisition. Key points:

Dividend payouts: We incorporate the 26cps fully franked special dividend paid by BLD in late April 2024 and a 30cps fully franked special dividend to be paid by SVW to all new and existing shareholders in FY25.

Leverage & subsequent de-leveraging: We estimate pro forma net leverage to be 2.7x FY24 EBITDA (including leases). Rapid de-leveraging should follow in FY25-26 with FCF generation of $612m in FY25 and $805m in FY26 expected. As result, we anticipate net leverage to trend below 2.0x by FY26.

FY24 guidance outperformance: We continue to believe SVW’s guidance to be conservative, forecasting 29% YoY growth in EBIT across the Industrial Services business (vs 20-25% guidance). The outperformance would be driven by robust pricing by BLD and strong growth in WesTrac new equipment and product support sales.

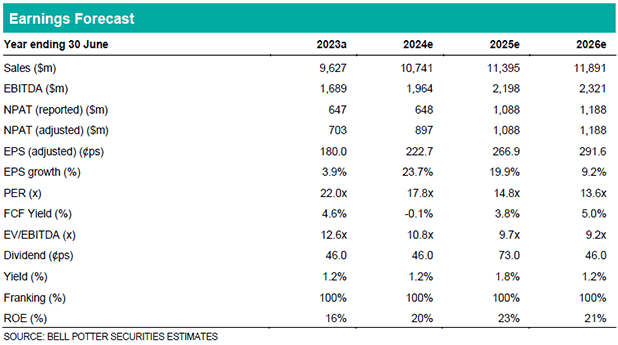

EPS changes: Reflect an updated SVW capital structure post-acquisition including a higher share count and debt raised, partially offset by an increase in attributable BLD earnings going forward: -2% FY24; -5% FY25; and -5% FY26.

Valuation changes: We now apply 100% ownership to our BLD valuation, with an upgraded valuation allowance for BLD’s surplus property portfolio, which is consistent with the Independent Expert Report published in March 2024.

Investment thesis: Buy; TP$45.00/sh (prev. $44.30/sh)

SVW’s businesses and investments are market leaders in their respective industries, with scale, brand and industry expertise underpinning commercial advantages that are hard to replicate by competitors. We are positive on the near-term outlook for mining production, engineering construction and transitional energy markets; critical minerals mining, renewable project construction and expected domestic and international gas supply shortfalls represent longer-term tailwinds.