Moving from turnaround to ‘growth’ phase

We initiate coverage of Retail Food Group (RFG) with a Buy rating at a $0.13/share Price Target. As Australia’s largest multi-brand retail food franchise owner in Quick service restaurants (QSR) and Coffee, the company franchises and operates stores in mass brands, Donut King & Gloria Jeans and other mid-market brands such as Crust Pizza in ANZ, US and EMEA. Trading at 4.6x FY24e P/E (BPe), the valuation looks undemanding given that RFG has undergone significant change over the past 5 years in a well progressed turnaround to move to a growth phase.

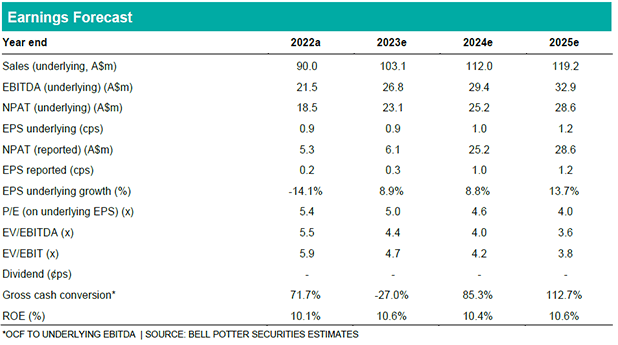

Capital light opportunities to lift group earnings by ~10% p.a

While RFG expects to return to net growth in its overall store count in FY24, we think that other growth initiatives such as add-on revenues from QSR stores and the ramp up in organic growth planned for the US market would drive further growth over the next few years. Led by the current management team in a well flagged progression plan (Matthew Marshall appointed CEO), these capital light opportunities will see RFG growing earnings at a faster rate over the medium to longer term while improving free cash conversion. We forecast Underlying EBITDA to grow at 11% p.a over the next 5 years driven by these initiatives. Post its recent trading update, RFG expects to deliver towards the lower end of the $26-29m Underlying EBITDA guidance for FY23e given the 2H macro headwinds and cycling of COVID comps in few major categories.

Investment View: PT $0.13, Initiate with BUY

We initiate coverage with a Buy rating and PT of $0.13 based on a blend of P/E (10.5x target multiple on a blended FY24/25e basis) and DCF (WACC ~12%, TGR ~3%) methodologies. In the currently emerging slower consumer spending environment, we think RFG could remain resilient considering the lower average transaction value (ATV below $9 ex-Pizza), which is well evident in the 2H to date update with all brands seeing growth in ATVs and the opportunities that we identify to improve pricing. We also see lower execution risk in the store roll out with a strong management team and growing support from stakeholders post the settlement of ACCC proceedings.