Quieter, not quiet period for announcements

The first 4 months of FY26 has seen PME announce three major deals in the US. This compares to just one (announcement) in the corresponding period for FY25, followed by a frenzy of 6 new contract announcements over the remainder of the fiscal year. We consider the quieter period for new contract announcements for the first 4 months of FY26 is not unusual, meanwhile contract implementations continue.

In the period since the company’s FY25 result announcement in August, it has completed numerous instals which include the first and largest cohort of the Trinity contract – live in recent days, in addition to Lucid Health (live in September) and the upgrade to FMOLHS. The Trinity ‘Go Live’ was the largest single Big Bang transition in recent history. The 2nd and 3rd cohorts are expected in mid and late CY2026. Once fully implemented we expect Trinity will add ~$30m in ARR in addition to becoming another flagship site for implementation across a very large, multi-site IDN.

Investment View: Upgrade to Buy, PT$320.00

The recurring nature of exam and baseline revenues (largely from Australia) contribute ~90% of forecast revenues, all of which is subject to long term contracts and or minimum volumes at fixed rates. The frenetic pace of implementations has continued in recent months, therefore, we anticipate professional services (including data migration) in the current half should be close to 2H25 levels.

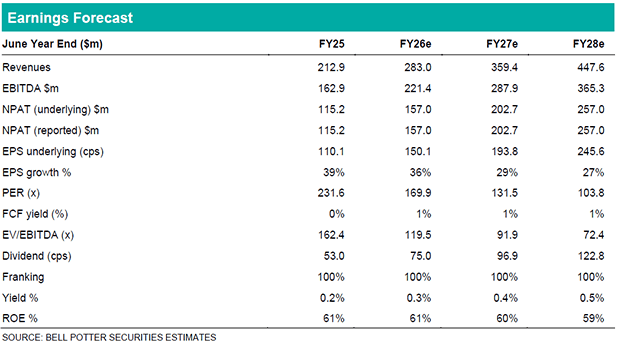

With earnings transparency remaining high, we attribute the recent sell off to profit taking following the string of new contract wins and record earnings in FY25. Consensus EPS is for FY26 is ~152cps representing ~38% growth. While PME remains expensive relative to peers, it is now trading 25% below its all-time high (achieved in July 2025). Catalysts include the RSNA trade show in late November which represents the major selling event of the year. In addition, we expect high profile renewals over the next 1 – 2 years from the likes of Yale New Haven and Mayo clinic. We upgrade our recommendation from Hold to Buy and maintain our target price at $320.00.