BHP conditionally offers $25.00/sh in cash

OZL has received an unsolicited, conditional and non-binding indicative proposal from BHP Group Limited (BHP:AU, not rated), to acquire all shares in OZL for A$25.00/sh in cash via scheme of arrangement. OZL’s Board has determined that it significantly undervalues OZL and is not in the best interests of shareholders. OZL cites factors including: its unique portfolio of high-quality copper and nickel assets in a Tier-1 mining jurisdiction; being the only primary copper producer in the ASX100; its high-quality growth projects, including West Musgrave, the Carrapateena Block Cave and Prominent Hill Extension; the strong long-term outlook for the copper and nickel markets; significant synergies and other benefits to BHP in SA and WA; and the growth and diversification OZL offers to BHP’s global copper portfolio.

Premium required to complete, potential for competing bid

In our view this puts OZL completely in play and, with an open register dominated by non-strategic institutional investors, we believe the chances of completion of the acquisition of OZL are high. We also believe this will be seen as an initial offer from BHP and that institutions will want to be compensated for the lack of large-cap investable copper producer options on the ASX. In the first instance, we expect a higher cash bid from BHP as the deal makes strategic sense and offers production growth in a secure jurisdiction. We also believe the scarcity of comparable assets in comparable jurisdictions makes the chances of a competing counter offer reasonable. Our previous valuation of $24.45/sh does not include a premium for control or scarcity.

Investment thesis – Hold, TP$25.00/sh (from Buy, $24.45/sh)

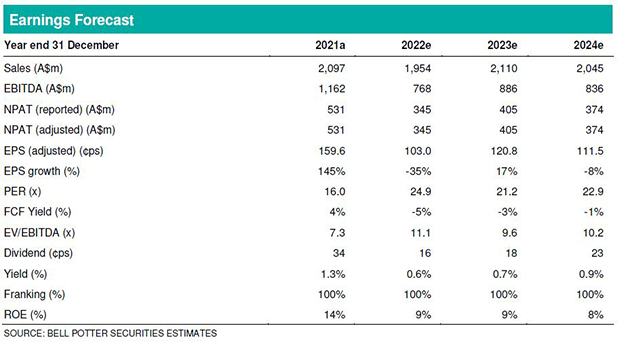

We view BHP’s proposal as offering competitive value but likely to be improved. However, the risk-adjusted potential upside is insufficient for us to maintain a Buy rating and we downgrade to Hold, with a strategy to see through to completion of an all-cash acquisition of OZL by BHP or a competing bidder at the current offer price or higher. We make no changes to our earnings forecasts and increase our valuation by 2% to match the current offer price of $25.00/sh.