Growing on tough pcp comps

3Q25 revenue: Revenue growth of +2.8% YOY in 3Q25 to $141.4m (vs. BPe of $145.0m) and driven by +3.9% YOY growth in the Dairy and nutritionals business. In the Dairy business, UHT domestic retail sales were up +14.6% YOY (with OOH up +2.4% YOY) and Nutritional ingredient sales up +30.9% YOY driven by a +31.5% YOY uplift in lactoferrin sales. Plant based sales were up +0.4% YOY (cycling +12.7% YOY in the pcp), with a notable +9.0% YOY uplift in Milklab branded product revenues.

Positive operating cashflow: 3Q25 operating cashflow was $15.2m (vs. $20.0m in 3Q24). Operating cashflows included -$2.4m in litigation costs (-$1.4m in 3Q24). At balance date NOU had $36.5m in unrestricted cash and available financing facilities (vs. $36.5m at 2Q25 and $42.7m at 3Q24). NOU made $4.6m in cash convertible note interest payments in the period.

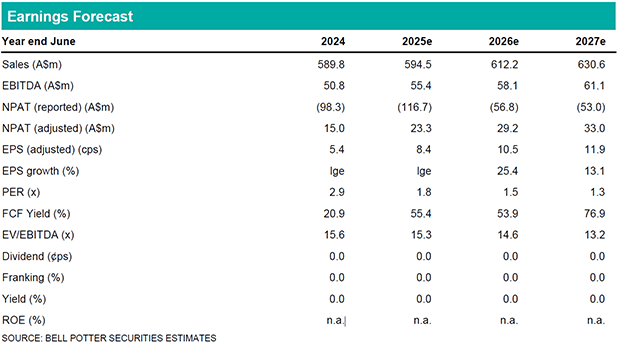

Litigation developments: NOU announced on 17/04 that the VIC Supreme Court had heard the Plaintiffs’ application to approve the terms of the settlement reached between the parties in Oct’24. The Court fixed a timetable for the Plaintiffs and Group Members to provide certain further material and otherwise reserved its judgment. There are no material changes to our EBITDA forecasts (i.e. +/- 1%) following this announcement. Our target price is reduced to $0.245ps (prev. $0.25ps) reflecting lower trading multiples in plant-based and functional FMCG peers.

Investment view: Buy rating unchanged

Our Buy rating is unchanged. The plant-based business continues to grow fuelled by the Milklab brand, Dairy is beginning to see the benefit of more favourable milk fat pricing dynamics, legacy legal issues look to be largely resolved and the business continues to demonstrate reasonable levels of operating cash generation. In addition, at 15.3x FY25e EBITDA, NOU remains relative value when compared to global plant based and functional FMCG peers.