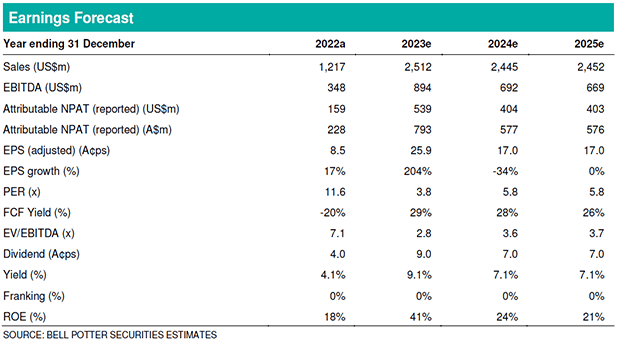

CY22 financial result

NIC reported its CY22 full year financial result delivering record production and financial performance. NIC reported consolidated revenue of US$1,217m (vs BPe $1,202m, up 88%), consolidated EBITDA of US$339m (vs BPe $327m, up 40%), consolidated NPAT of US$209m (vs BPe $195m, up 19%) and attributable NPAT of US$159m (vs BPe US$147m, up 15%). The main differences between the reported results and our forecasts were higher withholding tax payments and higher bond issue costs. NIC declared a final dividend of A2cps for total CY22 dividends of A4cps (vs BPe A3cps for the full year). NIC ended CY22 with cash of US$144m and gross debt of US$550m in Senior Secured Notes, for net debt of US$406m and net gearing of 24%.

Higher production and margins to drive growth in CY23

We forecast attributable nickel production to nearly double in CY23 and for earnings to grow significantly on higher, more stable margins as NIC benefits from increased exposure to the Class 1 products: high grade nickel matte and Mixed Hydroxide Precipitate (MHP) from High Pressure Acid Leach (HPAL) operations. High grade nickel matte sales of 4,743t in the December 2022 quarter achieved a margin of US$5,950/t, compared with average NPI margins for the December 2022 quarter of US$3,714/t. In addition, first attributable production from NIC’s 10% interest (pending shareholder approval) in the Huayue Nickel Cobalt (HNC) HPAL project is expected in coming months. It is guided to contribute ~6,000tpa attributable MHP at EBITDA margins of US$5,000-US$10,000/t.

Investment thesis – Buy, TP$1.87/sh (from Buy, TP$1.85/sh)

Earnings changes in this report are: CY23 +1%, CY24 +11%, CY25 +10%. Our NPV based valuation increases 1%, to $1.87/sh. NIC offers exposure to low cost nickel mining and production in Indonesia where it is expanding and diversifying across a range of nickel products and markets. Its aggressive growth outlook and undemanding valuation metrics make it one of our top picks. Retain Buy.