Nick Scali (NCK) provided an upgrade to 1H26 guidance on 22-Dec-25 (~12% at midpoint), guiding to Group Statutory NPAT of $37-39m vs previously $33-35m (as of 29- Oct-25). We had flagged positive catalysts on 1H earnings given supportive 2Q26 comps and the upgrade was driven by a higher 1H26 revenue guidance of 10-12% growth for ANZ vs previously 7-9% growth (on pcp). Both metrics were ahead of BPe/Consensus (BPe previously at top end of ANZ revenue growth guidance range and at mid-point of NPAT guidance range).

Earnings changes

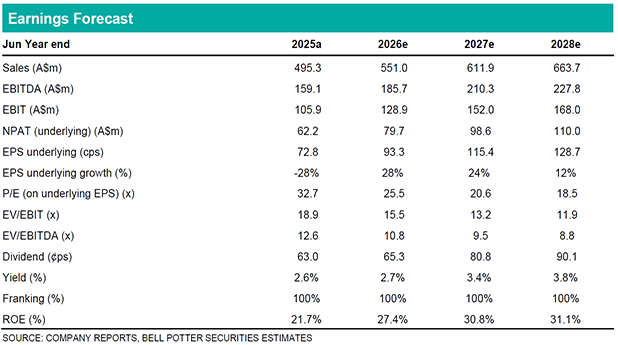

We factor in the upgraded guidance via our ANZ estimates and incorporate some further operating leverage. Our revised revenue estimates see ANZ +11% on pcp in 1H/FY26e, while UK +16% on pcp in FY26e. We now sit at the mid-point of the revenue growth and NPAT guidance range for 1H26e, however our 2H26e forward estimates unchanged. Our NPAT forecasts are upgraded by ~4% for FY26/27/28e.

Investment view: PT up 4% to $28.00, Maintain BUY

Our PT is up 4% to $28.00/share (prev. $27.00/share) driven by our earnings upgrades. Our target P/E multiple remains unchanged at 23x on a FY27e basis. While we remain cautious on the broader Consumer Discretionary sector given the pause in the rate cut cycle in Australia, we continue to favour key beneficiaries from the rate cuts seen so far and category outperformers. This supports our preference for NCK as we see steady market share in the core Nick Scali brand somewhat offsetting a less conducive macro environment, while further growth via the Plush brand over time in Australia and a larger opportunity in the UK offering sufficient growth levers. We view see this as backed up by the high-quality earnings model where NCK leads in its global peer group of household goods retailers, in addition to being the most attractive goods retailers within the ASX200 (on a growth adjusted basis). We also see further near-term catalysts for the upcoming Jan trading update, as the highly skewed seasonal month cycles attractive negative comps in written order sales. Maintain BUY.