FY24 result: 4% EPSA beat with good cash generation

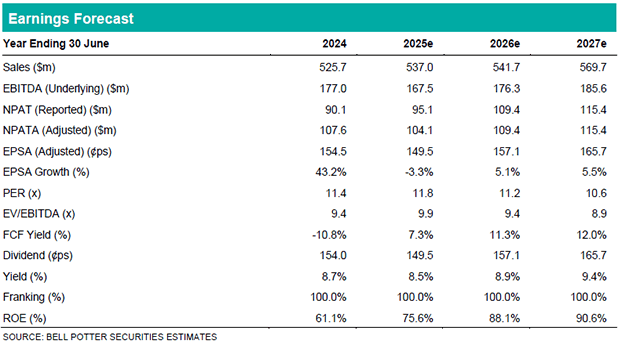

MMS released a very strong result, with FY24 Normalised Revenue/EBITDA/UNPATA growth of +12%/+35%/+38% vs pcp, respectively from continuing operations, lapping on weaker new car supply and delivery. Core EPSA of 154.5¢ps came in +2% above BPe (+4% vs VA cons). Divisionally, GRS delivered a beat at EBITDA, headlined by a 12-month contribution from EV demand and productivity benefits, while PPS missed expectations. AMS was in-line. Net cash (excl. fleet and warehouse debt) improved to $86.7m with cashflow conversion of 136%. MMS announced a better-than-expected final dividend of 78.0¢ps ff (BPe 75.9¢ps). Other highlights include:

Discovering new markets: MMS has soft launched a new brand ‘Oly’; designed as a simple and digitised novated leasing solution for small and medium sized businesses. MMS expects to complete rollout during FY25. We forecast higher margin contribution, driven by the favourable yield impact through higher priced EVs and lower refinancing.

Simply Stronger Program: MMS expects to finalise strategic initiatives and provided capex guidance of ~$11m for FY25 (incl. Oly), targeting a seamless client experience with self-service capability. We forecast a step-up for D&A in FY26 upon completion.

SA Government: The contract has been transitioned effective 1 July. MMS reiterated that the value represents ~7% of FY23 normalised GRS revenue. We forecast a $16m headwind, with controllable cost measures partly offsetting the impact.

Investment view: Maintain Buy rating

We adjust EPSA forecasts by +5%/+7% in FY25/26e, reflective of AMS strength and weaker PSS revenue expectations. With slowing orderbook growth, we have elected to lower the multiple and our SOTP valuation drops to $21.00 p/s. A further reduction in vehicle delivery timeframes has been experienced in July, with increased competition on price. Management also advised that settlements for combustion engines are down marginally vs pcp. We remain Buy rated, viewing MMS as a cash generative business with exposure to electrification. FBT legislation is scheduled for a review by mid-2027 and volume growth should be supported new customer segments in Oly.