Description: contracts, margins and capital

The company is a contract mining, and civil Infrastructure company. Its mining activities relate to the contractual operation of underground and surface mines in Australia and SE Asia (92%/8% of group revenue respectively), with the majority of the group’s exposure being to gold (54%) which is underpinned by the current strong gold price. The main contract mining businesses have relatively long-term projects, and make EBITDA margins of around 17%, or around 7-8% after depreciation.

Its civil infrastructure business has grown significantly with the acquisition of Decmil Gp (a civil construction company) in 2024. This has developed from providing mine support, to projects involved with renewables and infrastructure (roads, bridges, accommodation), with a range of short and medium-term projects. Capital required is lower than mining, but potentially has more competitors. Margins are lower than mining at the EBITDA level (around 7%), and slightly lower at the PBT level. The company has a long-term aim of rebalancing the business to 1/3rd 1/3rd 1/3rd underground, surface and civil, with a stated aim to grow underground by 50% over the next 2 years.

Investment view: Initiate with BUY PT $0.40/sh

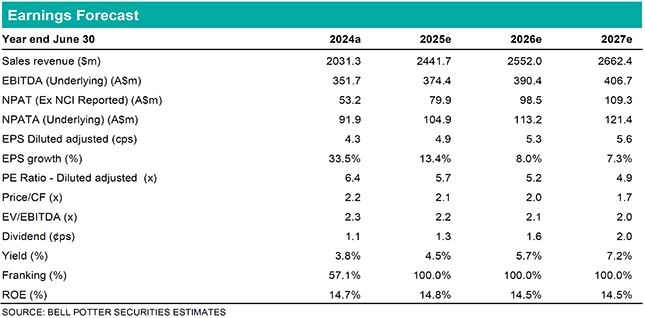

We see strong upside as the company delivers on: 1) Growth from underground mining (target of 50% growth in the next 2-3 years). 2) Growth from international, expected to reach 15% of group turnover. 3) Growth in civil as Decmil is able to scale with renewed balance sheet strength. 4) Upside from sale of the Homeground camp. 5) Scope for further acquisitions. 6) Rerating as the shares trade at just 5.7x FY25 EPS, or around NTA of $0.284 per share, but offer exposure to gold, limited tariff risk, and have high cash generation ($301m in FY24 pre capex or c50% of market cap) with an FY25 yield of 4.5%. The low rating of the shares relative to other mining contractors suggests that investor expectations are low, giving scope for upside surprise. We initiate coverage with a BUY, and value the shares at $0.40/sh using a DCF.