Q2 2024 update at a glance

LNW reported Q2 2024 results ahead of our estimates and VA consensus. Key points:

Profit & loss: LNW reported +12% YoY revenue growth in Q2 2024 to US$816m (BPe of US$798m and consensus US$796m), supported by +14% YoY growth in Gaming to US$539m (BPe US$512m), +8% YoY growth in SciPlay to US$205m (BPe US$208m) and +6% YoY growth in iGaming to US$$74m (BPe US$78m). Adjusted EBITDA was US$330m (BPe US$310m), supported by revenue growth and margin contribution from Gaming and SciPlay. Adjusted NPAT of US$98m was up +88% YoY (BPe US$91m).

R&D investment bearing fruit: LNW’s strong result was driven by a higher-than expected contribution from Gaming and SciPlay, supported by: net adds of 1.0k units (BPe 0.6k) to Nth. Am. install base; robust shipments into adjacencies, Australia and Macau; and +19% YoY (BPe 10%) growth in SciPlay AEBITDA underpinned by margin expansion of 309bps due to increased revenue from DTC platform.

Cash flow and balance sheet: Operating cash flow was US$141m (up 4.2x YoY), driven by earnings growth. Net debt (incl. leases) was US$3.6b, up from US$3.5b at March 2024, culminating in net debt leverage of 3.0x, within the company’s target

range of 2.5-3.5x.

Outlook: Management reiterated their confidence in achieving their 2025 AEBITDA target of US$1.4b, set out in 2022. LNW expects continued growth beyond 2025.

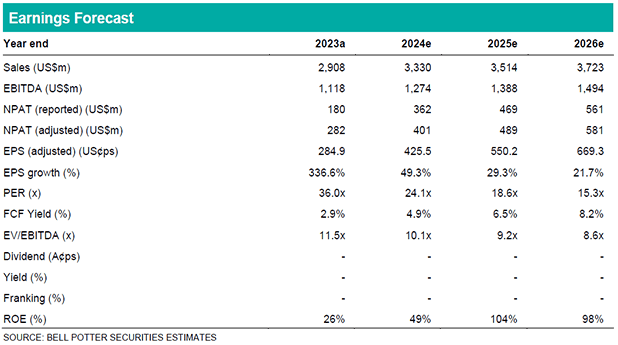

EPS changes: Following the result, we have upgraded 2024e EPS by 3% supported by higher international and adjacencies shipments and Nth. Am. install base net adds. Our TP is upgraded to A$186.00/CDI (prev. A$180.00/CDI) on higher free cash flow.

Investment view: Retain Buy; TP A$186/CDI (prev. $180/CDI)

We retain our Buy rating. We anticipate that LNW’s cross-platform strategy and leading scale will enhance game performance metrics relative to competitors in both land-based and digital markets. As a result, we expect improvement in product quality to strengthen LNW’s competitive advantage, allowing supporting higher ROIC.