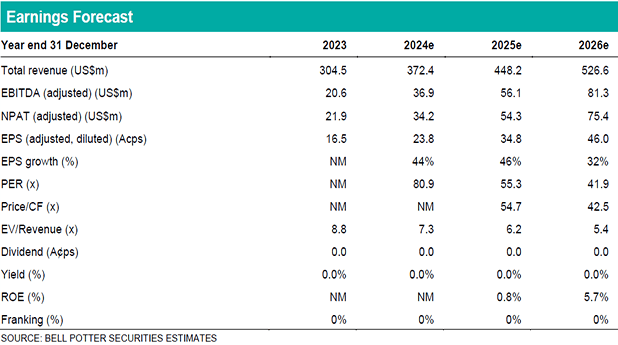

No change in forecasts

There is no change in our forecasts which we last updated at the release of the 2Q/1H2024 result in August. Our 2024 forecasts remain consistent with the guidance where we are around the middle of the adjusted and statutory EBITDA ranges and consistent with if not slightly below VA consensus. We continue to forecast strong top line revenue growth in 2024, 2025 and 2026 of 22%, 20% and 17% and positive statutory EBITDA and NPAT in 2025 and beyond.

Expecting a strong Q3

Life360 will report its 3Q2024 result on Wednesday, 13th November and we expect a strong result. Note Q3 is typically the strongest quarter for paying circle growth with back-to-school in the northern hemisphere. Our key forecasts for 3Q2024 are: Revenue up 22% y-o-y to US$96.2m; Paying circles up 121k q-o-q to 2.15m; ARPPC up 6% y-o-y to US$127.76; and AMR up 28% y-o-y to US$331.2m. We expect the company to reiterate its 2024 guidance but see some prospect of an upgrade at EBITDA given the relatively large uplift in H2 opex assumed in the current guidance.

Investment view: PT up 10% to $22.50, Maintain BUY

We have increased the multiple we apply in our EV/Revenue valuation from 6.25x to 7.0x due to the rally in the tech sector since we last updated our price target. We have also reduced the WACC we apply in the DCF from 9.1% to 8.6% due to a reduction in the risk free rate from 4.5% to 4.0%. The net result is a 10% increase in our PT to $22.50 which is >15% premium to the share price so we maintain our BUY recommendation. Potential catalysts for the stock include the upcoming Q3 result which, as mentioned, we expect to be strong with some potential of an EBITDA guidance upgrade. We also see some potential for the paying circle growth to positively surprise given our Q3 forecast of 121k is below the Q2 actual of 132k. Another potential catalyst is inclusion in the S&P/ASX 100 index at the next quarterly rebalance in early December which can cause some initial volatility in the share price but ultimately we expect the impact to be positive.