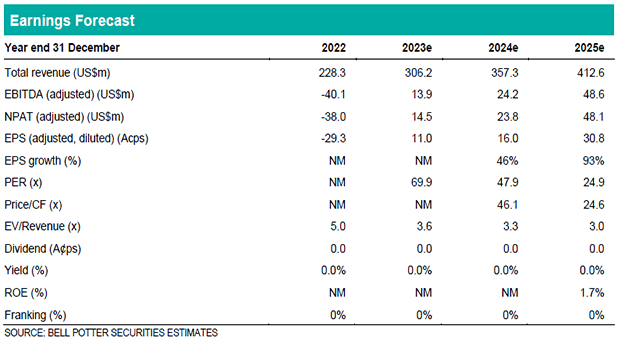

Revenue down slightly but EBITDA unchanged

We have reviewed our forecasts post the release of the 3Q2023 result a couple of weeks ago and made some minor adjustments. The key change is a 2% downgrade in our revenue forecasts in 2023, 2024 and 2025 driven by lower average revenue per paying circle (ARPPC) which has reduced our subscription forecasts. There is no change in paying circles forecast in 2023 and we have actually modestly increased our paying circles forecasts in 2024 and 2025. Despite the revenue downgrades there is negligible change in our EBITDA/adjusted EBITDA forecasts as we continue to expect good cost control and a trajectory to modest positive EBITDA in 2025. Note our 2023 forecasts are consistent with the guidance and we now forecast revenue of US$306m (vs guidance of US$300-310m) and unchanged adjusted EBITDA of US$13.9m (vs guidance of US$12-16m). That is, we expect the company to report within both guidance ranges and do not expect a beat in either.

Investment view: PT down 2% to $11.00, Maintain BUY

We have updated each valuation used in the determination of our price target for the forecast changes and also rolled forward the DCF by a year given we are getting close to year end. There are no changes in the key assumptions we apply which are a 3.75x multiple in the EV/Revenue and a 9.5% WACC in the DCF. The net result is a 2% decrease in our PT to $11.00 which is >15% premium to the share price so we maintain our BUY recommendation.

Q4 and 2023 result still a potential catalyst

Despite expecting a 2023 result consistent with the guidance we still see the result as a potential catalyst for the share price given the anticipated continued strong growth in paying circles (we forecast q-o-q growth of 82k to 1.83m) and also the provision of initial 2024 guidance. We forecast 2024 revenue and adjusted EBITDA of US$357m and US$24.2m which equate to growth of 17% and 74% respectively. Guidance consistent with our forecasts would be well received in our view and would also

suggest that cash will grow by around US$15m or more over the year.