Solid FY25 result largely in-line with BPe

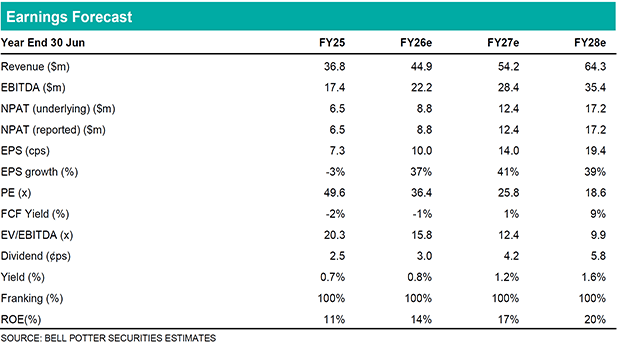

LGI’s FY25 result detailed a solid full-year performance, with most figures ahead of or in-line with our estimates. Revenue of $36.8m (+10.4% YoY) was a slight miss to BPe ($37.9m), however strong margins drove a slight beat at both EBITDA ($17.4m vs $17.2m BPe) and NPAT ($6.5m vs $6.4m BPe). LGI delivered diluted EPS of 7.3c and declared a final dividend of dividend of 1.3c, which translates to a full-year dividend of 2.5c (BPe $2.4c). The company recorded operating cashflow of $12.3m (BPe $13.3m) and had a cash balance of $3.3m at 30-Jun-25.

Operational performance

The company again delivered a strong operational performance, with growth across all metrics. LGI generated Biogas flows of 127.7 million cubic meters (+10.9% YoY), Mega Watt Hours (MWH) of 109,119 (+13.3% YoY, BPe 107,999) and created 493,446 ACCUs (+14.0%, BPe 461,369). Further, the company has increased the MW operating capacity to 21.1MW at 30-Jun-25, an increase of 43% YoY (14.7MW).

Bullish outlook

In our view, the key highlights relate to the increased pipeline and strong EBITDA guidance. LGI announced a contract to explore the viability of a 12MW / 24MWh gridscale battery project at WAMC’s Belrose closed landfill site, which would increase the contracted and funded development pipeline to a capacity of 56MW (prev. 47MW). Further, the company provided guidance for EBITDA growth of 25% to 30%, implying a range of $21.8m to $22.6m and ahead of our original estimate ($21.1m).

Investment view: $4.25 PT, Retain BUY

We anticipate the ramp up to a 21.1MW operating capacity and the scheduled pipeline to reach 56MW to be reflected in significant earnings growth for LGI through FY26 and the coming years. Our updated PT of $4.25 is a >15% premium to the current share price so we maintain our BUY recommendation.