Top end of guidance

Integrated Research (IR) provided an FY24 trading update and effectively narrowed the previously provided guidance ranges to the top end: Revenue up 17% to b/w $82- 84m (vs previous $76-85m and BPe $78.2m); EBITDA up 90-107% to b/w $23-25m (vs previous $18-25m and BPe $18.8m); and Total contract value up 20-23% to $82-84m (vs previous $75-84m). The company also said cash at 30 June was $31.9m which was ahead of our forecast of $29.4m. IR also provided some outlook commentary for FY25 and said: Renewals are expected to be weighted to the second half; The full year will rely more on new business than in FY24; and The company will review its resourcing and capital plans mindful of the need to invest in new products for incremental growth but also the strength of the Balance Sheet. The company also announced John Ruthven will step down as CEO but no replacement was announced.

Upgrades in FY24 but little change thereafter

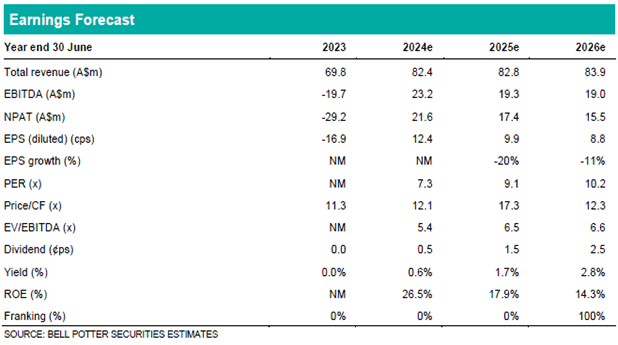

We have upgraded our FY24 revenue and EBITDA forecasts by 5% and 23% to be within the updated guidance ranges albeit towards the lower end. There is very little change in our FY25 and FY26 forecasts and we wait for further clarity on the outlook to be provided at the release of the FY24 result next month. At this stage our revenue forecasts are relatively flat in FY25 and FY26 which is in part due to the flagged greater reliance on new business in FY25 relative to FY24. Our EBITDA forecasts are lower, however, than FY24 due to assumed increased investment in products.

Investment view: PT up 11% to $1.05, Maintain BUY

We have updated each valuation used in the determination of our price target for the forecast changes and also rolled forward the DCF by a year. We have also increased the multiples we apply in the PE ratio and EV/EBITDA valuations from 9.5x and 7.25x to 10.5x and 7.75x and also reduced the WACC we apply in the DCF from 10.2% to 9.7% due to the strong FY24 result and relatively positive outlook. The net result is an 11% increase in our PT to $1.05 which is >15% premium to the share price so we maintain our BUY recommendation.